What Comes Under Gst

Instead of VAT service tax etc a single GST is charged on the value of goods and services. The sub-contractor will charge GST in the tax invoice raised on the main contractor.

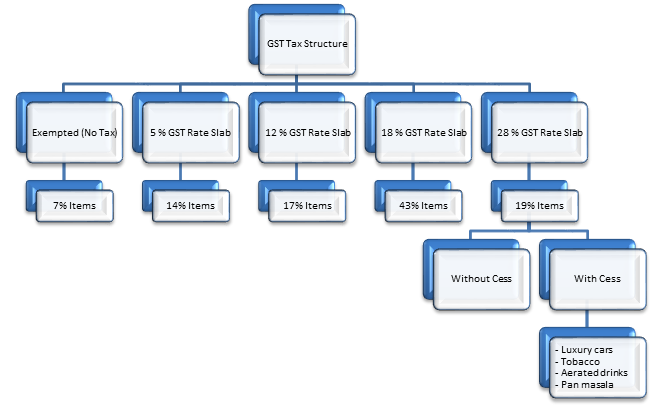

Gst Rate Slabs Simplified Kotak Bank

Gst Rate Slabs Simplified Kotak Bank

Like all such taxes there are few exceptions even under GST where goods or services are exempt from tax liability.

What comes under gst. Turnover in simple terms is the total volume of business. GST Acts IGST Act 2017 as amended up to 01102020. Physical Natural Person who can perform legal action for himself Yes If cross threshold comes under other conditions mentioned below Aggregate turnover in Rs.

40 Lakh for supplier of goods And Rs. GST Rates of Goods. Household necessities such as edible oil sugar spices tea and coffee except instant are included.

Refund in case of Inverted Duty Structure under GST According to Section 543 of the CGST Act 2017 a registered taxpayer can claim refund of unused Input Tax Credit at the end of any tax period. However it does not include inward supplies on which tax is payable under Reverse charge. Also a minor portion of all goods and services under the GST regime does not invite any tax including different salt types and most recently sanitary napkins.

This includes computers and processed food. The taxpayer has to claim his refund of unused ITC on account. Decisions taken by the GST council in the 16th Meeting.

20 10 Lakh for Service Provider 2. Similarly the sale of life-saving drugs or books meant for reading in different state governments were exempt from taxes. The GST tax is levied based on Revenue Neutral Rate RNR.

Individual with Unsound Mind Minor Yes If cross. Apart from these GST on gold is 3 and 025 of semi-precious and rough stones. Goods The goods which will attract a taxation of 5 under GST include skimmed milk powder fish fillet frozen vegetables coffee coal fertilizers tea spices pizza bread kerosene ayurvedic medicines agarbatti sliced dry mango insulin cashew nuts unbranded namkeen lifeboats Ethanol- Solid biofuel pellets- Handmade carpets and other handmade textile floor.

Cut and semi-polished stones are included under this tax slab. For example a building developer may engage services of a sub-contractor for certain portion of the whole work. List of Services under reverse charge.

GST Rates of Services. The Goods and Services Tax GST has replaced all other types of indirect taxes applicable on goods and services. For better understanding and proper accounting all the taxes were merged under one umbrella known as GST.

Before the advent of Goods and Service tax GST we consumers paid various kinds of taxes under different categories like direct taxes and indirect taxes. It means total value of all taxable supplies and exempt supplies including export of goods or services and inter-state supplies of goods or services. Most of the other products are kept under 18 tax bracket.

The supplies that are excluded from the scope of GST must be covered within this definition. However these five petroleum products such as crude oil petrol diesel ATF and natural gas were excluded from the. For instance under the service tax regime clinical and education services were exempt from service tax.

Such exemptions on specified goods or services. There are different GST rates applicable for different types of goods and services. IGST Exemption Concession List as on 03062017.

A non-taxable supply means a supply of goods or services that does not come under GST law. Coal MishtiMithai Indian Sweets and Life-saving drugs are also covered under this GST slab. Exempted Categories under GST in India.

There must be a supply of goods or services or both to have qualified under the non-applicability of GST. Most of the items of daily consumption of masses are charged 5 tax while luxury items invites 28 tax. However the Turnover has been defined under the GST law.

Classification Scheme for Services under GST. Natural gas jet fuel may come under GST At least two petroleum commodities natural gas and aviation turbine fuel ATF could be brought under the Goods and Services Tax GST net to facilitate a gas-based economy and to furnish a stimulus to the pandemic-hit aviation sector after the GST Councils approval two people aware of the. Home Business Natural gas jet fuel may come under GST Five petroleum products crude oil natural gas ATF petrol and diesel are outside the GST structurePTI file photo business.

Under GST regime there are five distinct tax slabs to make tax collection easy these are 0 5 12 18 28. However in some instances no GST is levied. These 4 categories of goods and services are as follows.

With the launch of GST in July 2017 certain petroleum products such as kerosene naphtha and LPG were included under the GST regime. GST GOODS AND SERVICES TAX WORK CONTRACTS in GST the same line of business and is using such services received for further supply of works contract service. For the purpose of imposing GST tax in India the goods and services are categorised in to four.

These taxes are levied upon good and services at every stage of the supply chain. What is Included Under the 5 GST Rate List. Revised Threshold for Composition Scheme as on 11062017.

Place Of Supply Pos Under Goods And Services Tax Gst Goods And Services Goods And Service Tax Best

Place Of Supply Pos Under Goods And Services Tax Gst Goods And Services Goods And Service Tax Best

Gst One Nation One Tax Goods And Service Tax Goods And Services India

Gst One Nation One Tax Goods And Service Tax Goods And Services India

Records And Accounts To Be Maintained By Taxpayer In Gst Records Accounting Registration

Records And Accounts To Be Maintained By Taxpayer In Gst Records Accounting Registration

1 Minute Ago Gstalert Gst Gstfornewindia Sayings Finance

1 Minute Ago Gstalert Gst Gstfornewindia Sayings Finance

Pin By Rajesh Doye On Gst India Goods And Services Tax Goods And Services Education Indirect Tax

Pin By Rajesh Doye On Gst India Goods And Services Tax Goods And Services Education Indirect Tax

Features Of The Proposed Payment Procedures Under Gst Payment Procedure Payment Processing

Features Of The Proposed Payment Procedures Under Gst Payment Procedure Payment Processing

About Gst Goods And Service Tax Gk Question In Hindi This Or That Questions

About Gst Goods And Service Tax Gk Question In Hindi This Or That Questions

An Overview Of Blocked Itc Under Gst Goods And Service Tax Goods And Services Free Supplies

An Overview Of Blocked Itc Under Gst Goods And Service Tax Goods And Services Free Supplies

Third Country Exports Under Gst Exports Goods And Service Tax Country

Third Country Exports Under Gst Exports Goods And Service Tax Country

Pin On Real Estate Property In India

Pin On Real Estate Property In India

Supply Under Gst Definition Meaning Scope Of Taxable Supply

Supply Under Gst Definition Meaning Scope Of Taxable Supply

Services That Comes Under Gst Moneymindz Com Visit Https Www Moneymindz Com Give Misse Personal Financial Planner Education Journals Financial Advisory

Services That Comes Under Gst Moneymindz Com Visit Https Www Moneymindz Com Give Misse Personal Financial Planner Education Journals Financial Advisory

Export Documents Under Gst According To Section 16 Of Igst 1 Zero Rated Supply Means Any Of The Following Supplies Of G Customs Clearance Custom Documents

Export Documents Under Gst According To Section 16 Of Igst 1 Zero Rated Supply Means Any Of The Following Supplies Of G Customs Clearance Custom Documents

Register Yourself With Gst Registration Goods And Service Tax Financial Services

Register Yourself With Gst Registration Goods And Service Tax Financial Services

List Of Gst Sections And Relevant Rules Goods And Service Tax Goods And Services Rules

List Of Gst Sections And Relevant Rules Goods And Service Tax Goods And Services Rules

Introduction Of Goods And Service Tax Gst Goods And Service Tax Goods And Services Indirect Tax

Introduction Of Goods And Service Tax Gst Goods And Service Tax Goods And Services Indirect Tax

Value Of Supply Goods And Services Money Change Goods And Service Tax

Value Of Supply Goods And Services Money Change Goods And Service Tax

Gst Registration Process Types Benefits Enterslice Goods And Service Tax Registration Legal Services

Gst Registration Process Types Benefits Enterslice Goods And Service Tax Registration Legal Services