Where Do I Send 1099 Misc Forms In Pa

Does a company based in a state other than Pennsylvania have to file 1099-MISC forms with the Pennsylvania Department of Revenue. Mail 1099-MISC forms to.

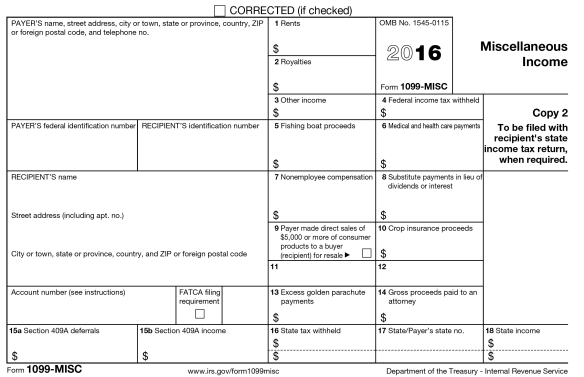

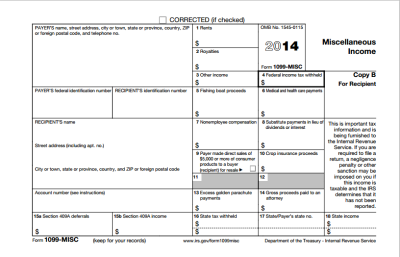

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

As with most other tax types having employees or independent contractors.

Where do i send 1099 misc forms in pa. If you received unemployment compensation during the year you should receive Form 1099-G from your states unemployment office. It is possible you may receive more than one 1099-G form. You will need to file Form CT-W3 with Forms W-2.

The IRS has a number of 1099 variations in use. PUA will be reported on a separate form from any UC including PEUC EB TRA that you may have received. Bureau of Individual Taxes.

The 1099-G will affect the filing of your federal income tax return if you itemized deductions the prior year and claimed state income tax paid as a. This form is used to indicate the amount of payments made to a particular Social Security Number SSN or Tax Identification Number during a calendar year. Mailing Address For Taxpayers Filing Less Than 10 Form 1099s with REV-1667.

When filing federal copies of forms 1099 with the IRS from the state of Pennsylvania the mailing address is. PA Department of Revenue. If you still want to file 1099 forms by paper send the forms with a copy of 1096 and REV 1667 to the following mailing address.

Department of the Treasury Internal Revenue Service Center Austin TX 73330. If the entity is issuing 9 or fewer paper 1099R with a premature distribution of a pension or profit-sharing plan or a 1099 MISCNEC that has zero PA withholdings the forms should be mailed to. Department of Revenue Services.

Some states require separate notification from the employer that they are filing 1099 forms through the CFSF Program. PA DEPARTMENT OF REVENUE BUREAU OF INDIVIDUAL TAXES. For more information refer to.

The new rules are both difficult and complex. PA DEPARTMENT OF REVENUE PO BOX 280904 HARRISBURG PA 17128-0904 Mailing Address For Form 1099-R or 1099-MISC Showing Zero Withholding. Medical Assistance MA deals with 1099-MISC forms only for MA purposes.

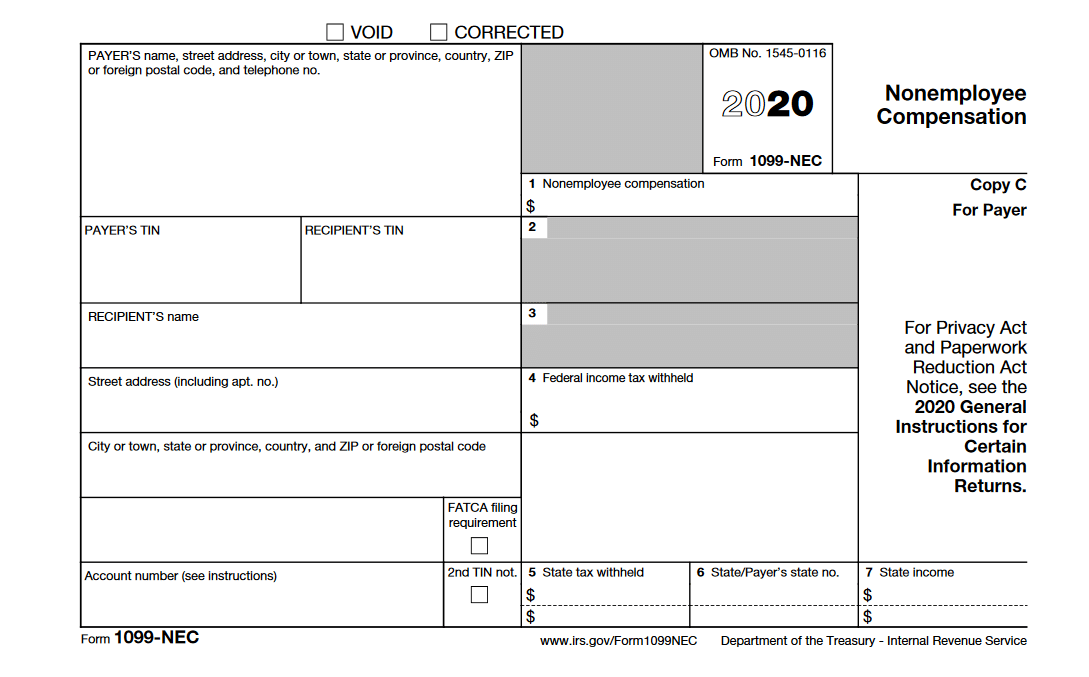

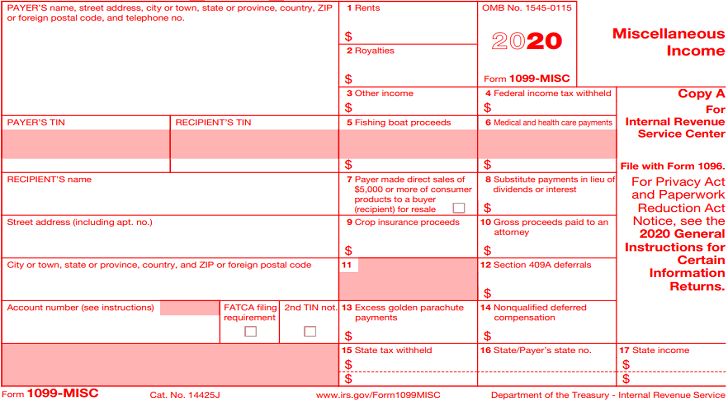

You will need to add the payments from all forms. 1099-MISC Income form and has implemented a new 1099-NEC Nonemployee Compensation form 1099-NEC for reporting nonemployee compensation starting with tax year 2020 filing. Having said that there is practical wisdom in.

Mail W-2 forms to. File a copy of the Federal Form 1099-MISC with the Department by January 31 of the next year. File a copy of the Federal Form 1099-MISC with the payee by January 31 of the next year.

Form 1099-G is a federal form that the Internal Revenue Service requires be provided to taxpayers to remind them of the Pennsylvania income tax refunds or credits they received the previous year. PA Department of Revenue PO. Yes a 1099-MISC is required to be filed with the Pennsylvania Department of Revenue if compensation is paid for services performed in Pennsylvania.

When filing state copies of forms 1099 with Pennsylvania department of revenue the agency contact information is. PA Department of Revenue. You will need to file Form CT-1096 with Forms 1099-MISC.

I think the above answer by KellyG is marginally helpful as the OP asks do I have to copy the form 1099-R for the PA Tax and send it with my return. Information Return is a federally required form. Mailing Address of Form 1099-MISC.

If the payor or lessee must electronically file Pennsylvania employer withholding the Form 1099-MISC must be filed electronically. If the entity issuing the 1099-MISC does not have a PA employer withholding account or the entity is issuing 9 or fewer paper Forms 1099-R1099-MISC showing zero PA withholding the forms can be mailed to. Form 1099-MISC is used to report miscellaneous.

You must e-file forms if submitting 25 or more Forms W-2 or 1099-MISC. New Mexico 1099. Nonemployee compensation was previously located in Box 7 of the 1099-MISC form and is.

Box 280412 Harrisburg PA 17128-0412. Whether or not you would need to attach the 1099-R to the state return will depend on whether or not PA tax was withheld. Box 2930 Hartford CT 06104-2930.

1099r do I have to copy the form for the PA Tax and send it with my return and if so how do I do that. Department of Revenue Services State of Connecticut PO. You wont be penalized for sending in an extra form but you dont want to have issues with not sending in a required form.

Mail your Pennsylvania state 1099 forms to. RTAA benefits are also reported on a separate form. If you are unsure attach it and send it in.

Companies meeting the withholding requirements are required to apply for a 1099-MISC withholding account via Form PA 100 which can be done electronically at wwwpa100statepaus. The IRS acts as a forwarding agent only so it is your responsibility to contact your state to verify that they have received the form and to find if they need additional information.

1099 Misc Form Copy B Recipient Discount Tax Forms

1099 Misc Form Copy B Recipient Discount Tax Forms

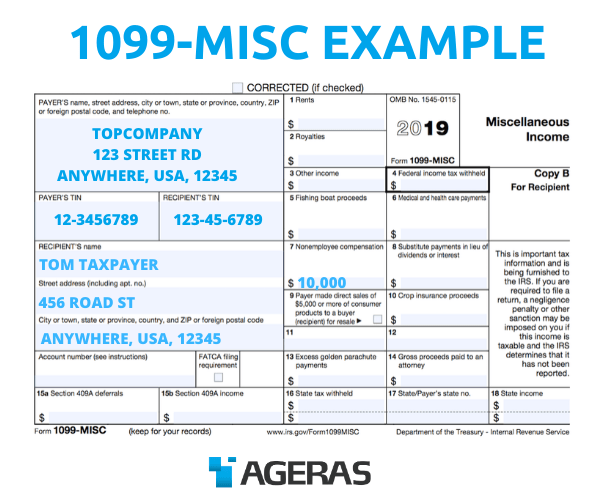

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Action Required For Tax Form 1099 Filers Blog For Accounting Quickbooks Tips Peak Advisers Denver

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Which 1099 Forms Should You Complete

Which 1099 Forms Should You Complete

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

1099 Tax Form Regulations Tax Preparation Pittsburgh

1099 Tax Form Regulations Tax Preparation Pittsburgh

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form 5 Part Carbonless Discount Tax Forms

1099 Misc Form 5 Part Carbonless Discount Tax Forms

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Amazon Com Tops 1099 Misc Forms 2019 5 Part Tax Forms 50 Recipients Laser Inkjet Forms 3 1096 Summary Forms Txa22993 White Tx22993 Office Products

Amazon Com Tops 1099 Misc Forms 2019 5 Part Tax Forms 50 Recipients Laser Inkjet Forms 3 1096 Summary Forms Txa22993 White Tx22993 Office Products

What Is Irs Form 1099 Misc Erie News Now Wicu And Wsee In Erie Pa

What Is Irs Form 1099 Misc Erie News Now Wicu And Wsee In Erie Pa

What Is A 1099 Form And Do I Need To File One River Iron

What Is A 1099 Form And Do I Need To File One River Iron

1099 Misc Forms Set Discount Tax Forms

1099 Misc Forms Set Discount Tax Forms