How Do I Check A Companies Vat Registration Number

8 x 4 32. How do I check a VAT number.

Click Do the search and the details will appear on your screen within a few seconds.

How do i check a companies vat registration number. How you contact the national authorities varies from country to country. There are many steps to take but you want to ensure that all documents are legitimate. As mentioned previously this does not work now on very new vat registration numbers.

Contact Imprint GTC About VAT-Searchie Language. Results are limited to a maximum of 19 possible companies in the results list. VAT-Search has more than 600 clients including.

Therefore dont worry if it doesnt work for your company. 3 x 8 24. Get company information including registered address previous company names directors details accounts annual returns and company reports if its been dissolved.

You can check a Company Registration Number on the Companies House Website. Deduct 97 twice from this to make the result negative and the result is 180-97-97-14 which is the same as the last two digits so the VAT number is valid. Using a Trading Name to find the VAT Number.

4 x 3 12. Some sole traders do opt to include their UTR number on their invoices. The name and address of the business the number is registered to.

Register or log in to access your account. On the CIPROZA website select company search and enter the registration number using the format YYYY. Post registration for VAT the business is provided with a unique VAT number that other businesses need to reclaim the tax paid.

6 x 7 42. Some EU countries have online systems while you have to contact others by phone mail or. Follow the prompts to make a payment.

51 rows VAT lookup enables you to lookup and verify VAT numbers. If the VAT number is valid or not. Consequently where vendors are newly registered the number being searched may not yet appear.

The total of the above calculation is 24423030321210180. If you are dealing with a VAT registered Sole Trader then there will probably be only the VAT number on their invoices. If a UK VAT registration number is valid.

There is no legal requirement to do this. Start by accessing the SARS VAT Vendor Search page. If the VAT number is associated with a certain name and address.

Select Verify VAT registration certificate service. By using VAT-Searchie you agree that this website stores cookies on your local computer in order to enhance functionality such as remembering your input for further queries. Businesses can find their VAT registered number on the VAT registration certificate issued by HMRCHM Revenue Customs.

Enter a minimum of 5 characters to get a listing of possible matches continue to add characters to the search criteria until it narrows the results to the trade name you looking for. This search is free of charge. You can also check VAT.

Steps to complete the service Enter the Authority Portal. 5 x 2 10. Ways to check Chinese company registration number.

Users must please note that the database is updated weekly. Select Verify service from the list of online services. Full details when you have the registration number.

Most businesses can be registered online. Verify the Existence of an Enterprise. 6 x 5 30.

Read and agree to the terms and conditions and then proceed to search for the VAT vendor. The VAT Vendor Search is subject to the general Terms and Conditions of SARS e-Filing. Just check that the vat registration number is valid per the VIES vat validation website.

5 x 6 30. Registering Your Company For VAT. Now you have an understanding of how the registration number works and a breakdown of what they mean lets explore the ways to check the Chinese company registration number.

If you use this search you will be able to view if a company exist and if so what the Enterprise Name Enterprise Number Registration Date is and the status of the enterprise if the enterprise is in business as well as the Registered and Postal Address of the enterprise.

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

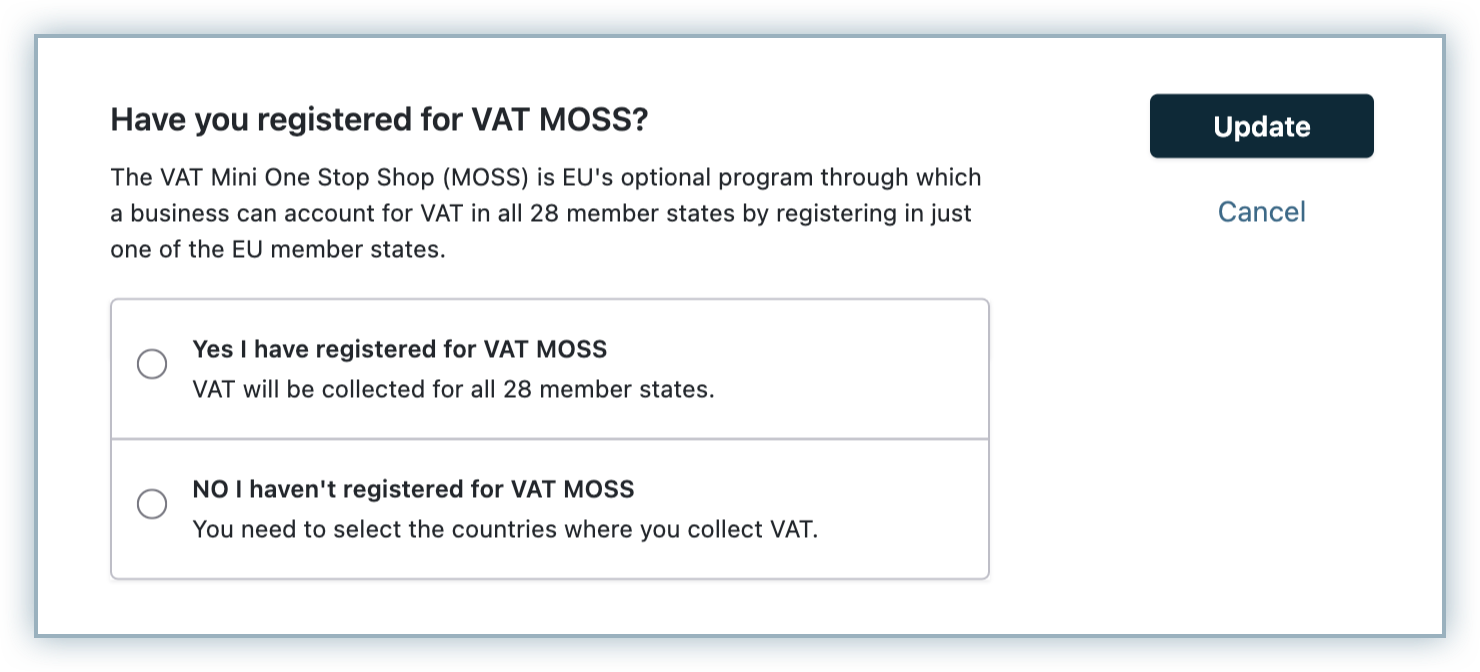

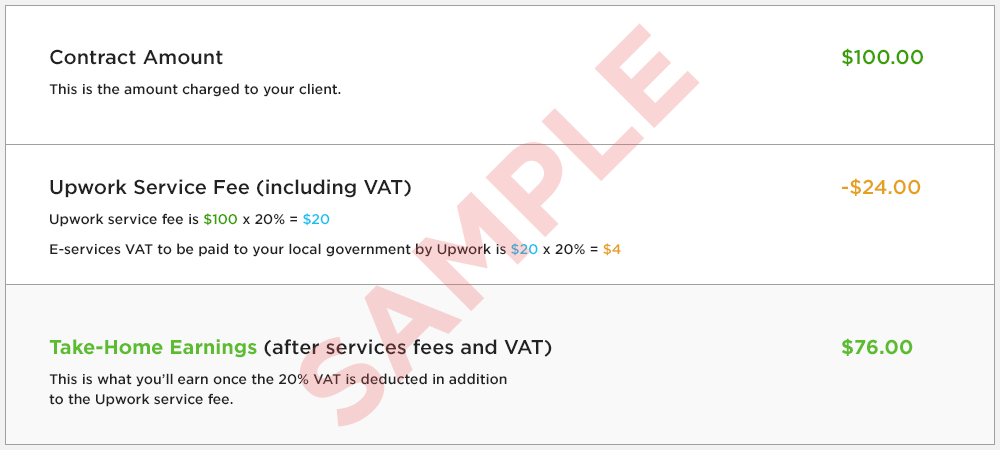

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

Value Added Tax Vat Upwork Customer Service Support Upwork Help Center

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

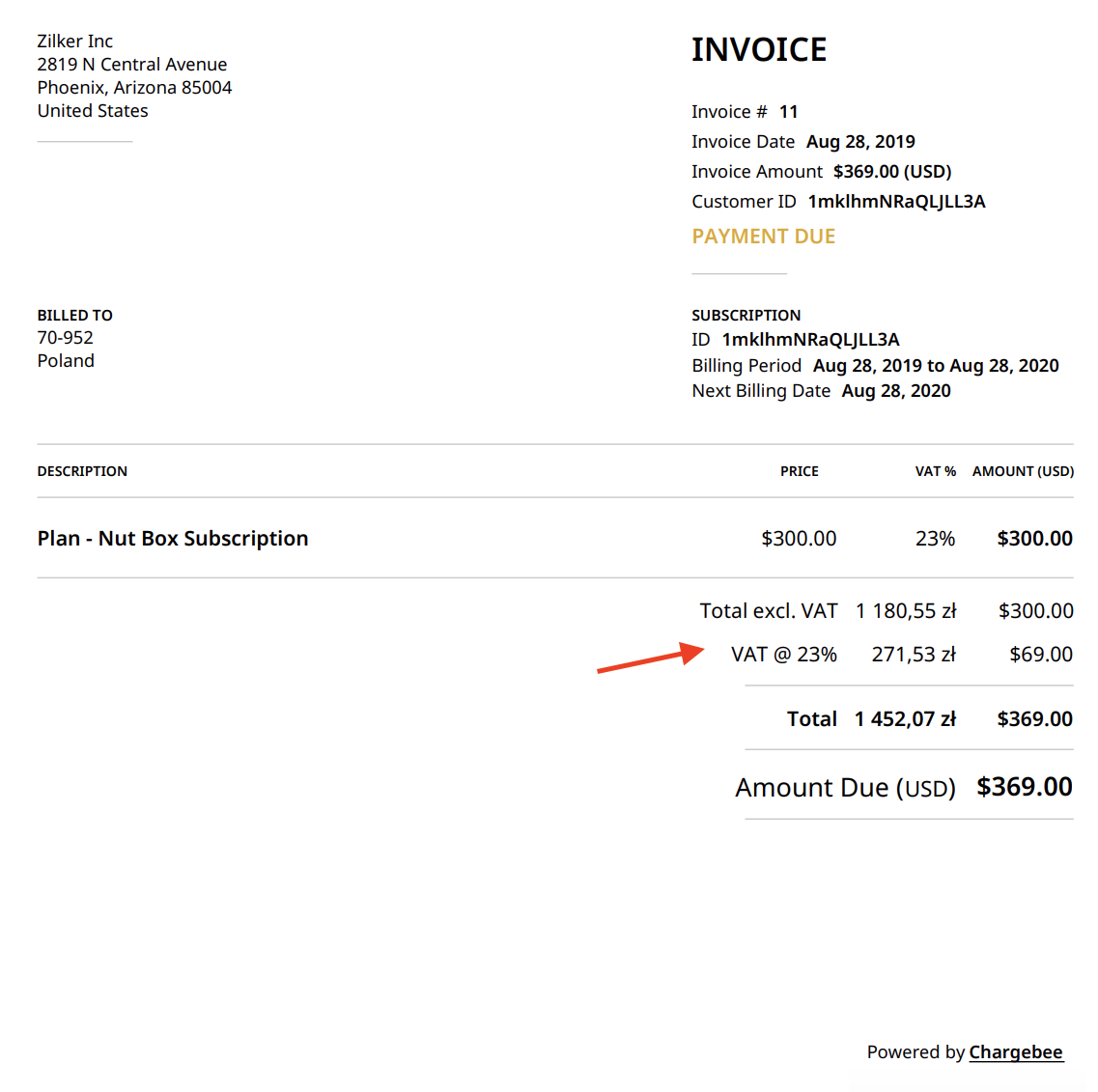

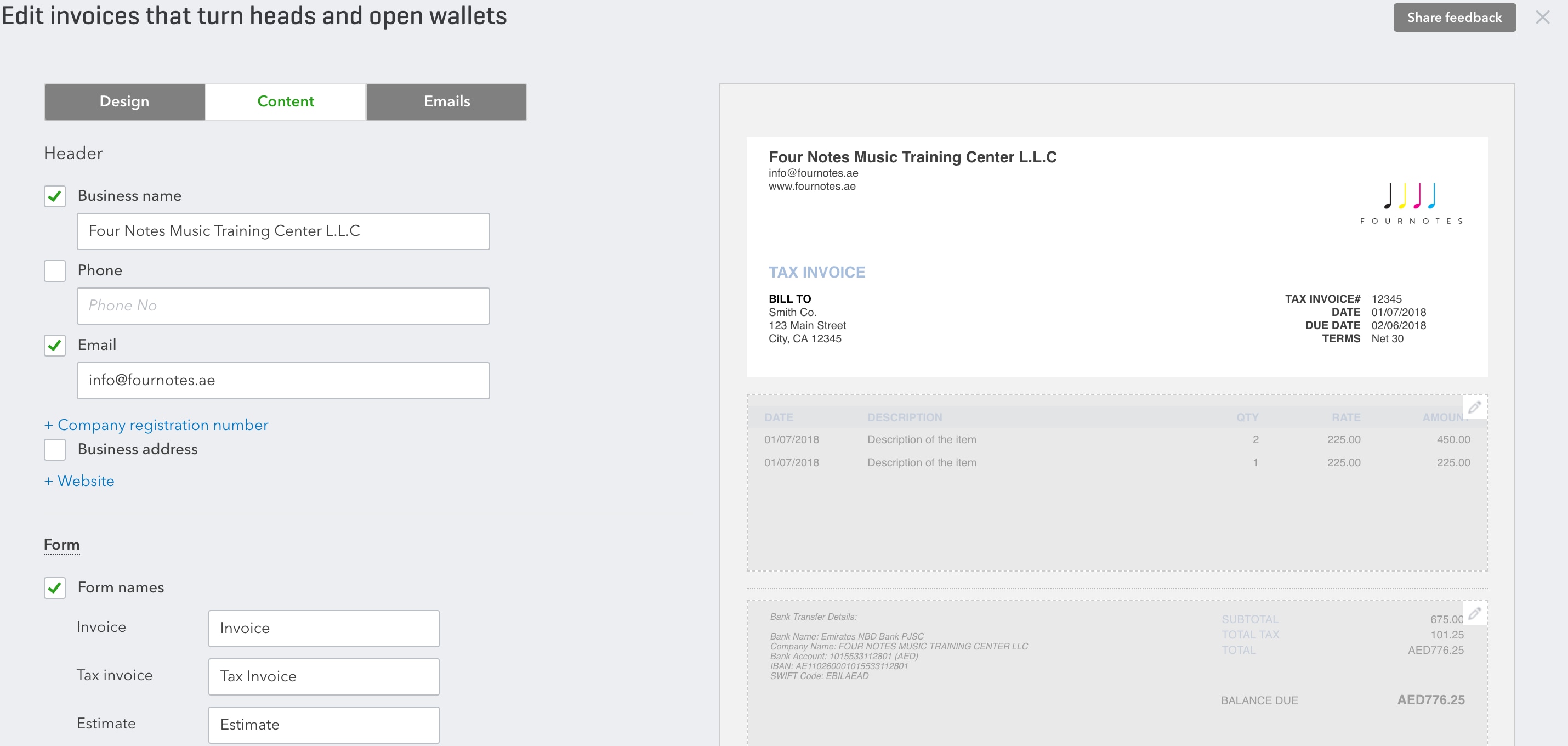

How Do I Add Vat Number To Invoice

How Do I Add Vat Number To Invoice

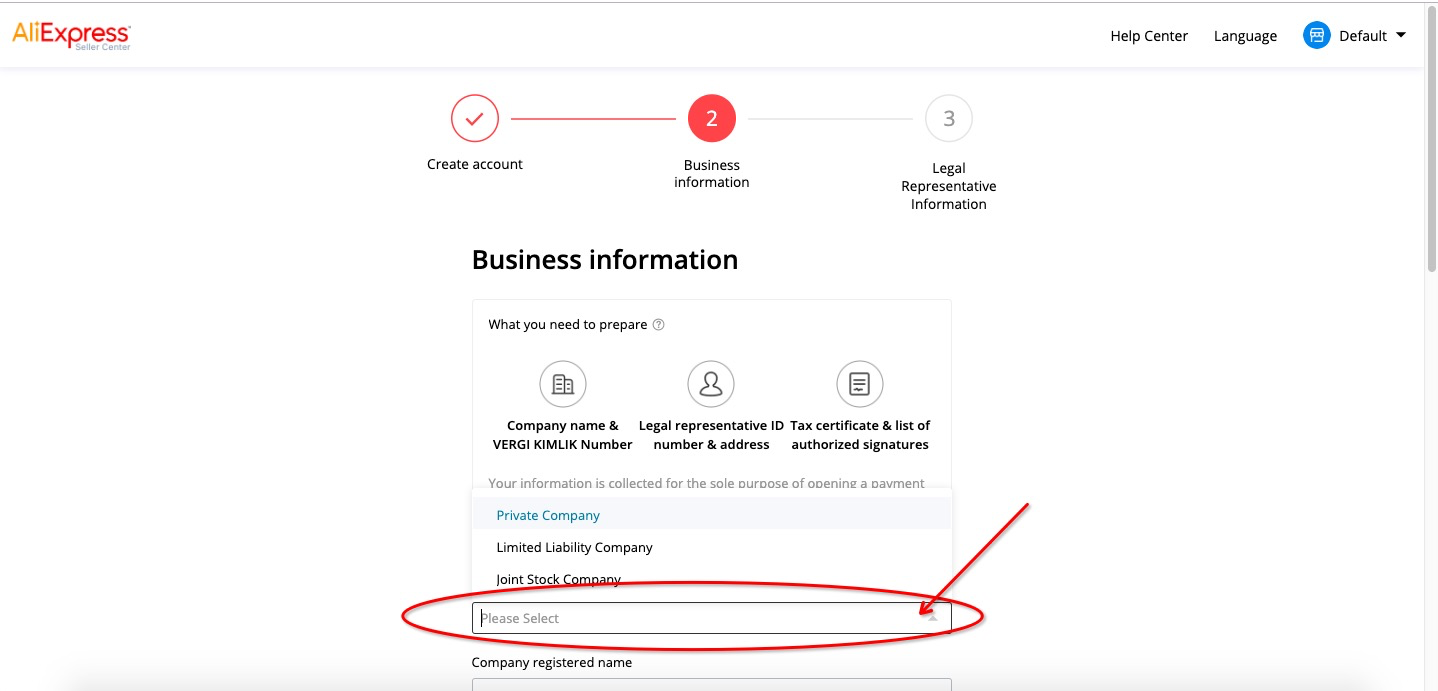

Automatic Vat Validation For Eu Sap Blogs

Automatic Vat Validation For Eu Sap Blogs

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

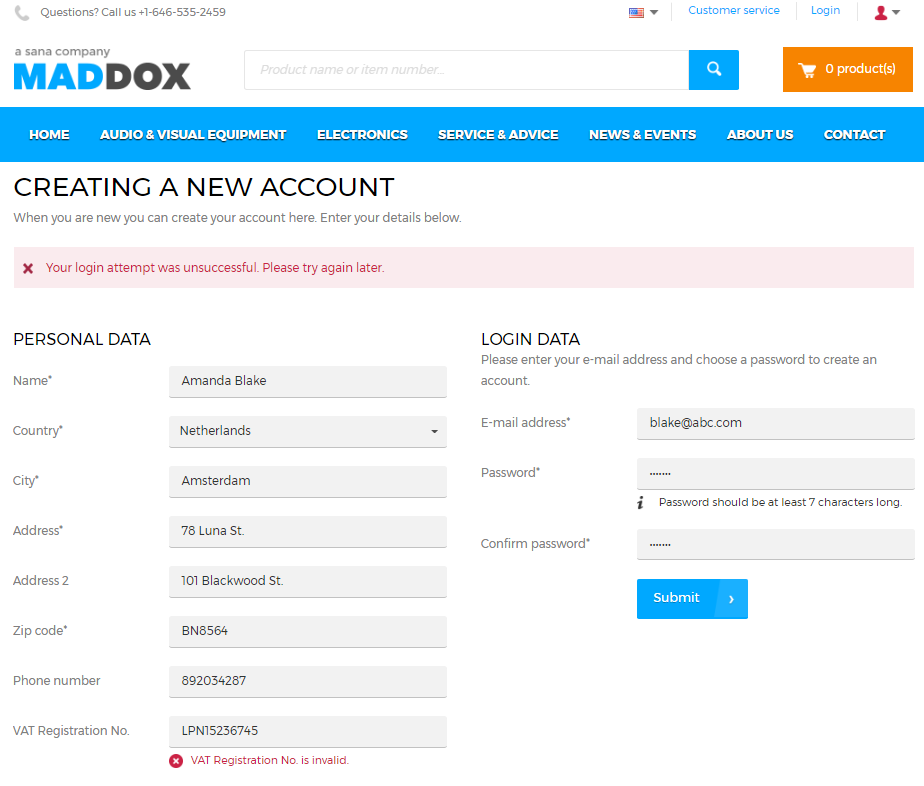

Automatic Vat Validation For Eu Sap Blogs

Automatic Vat Validation For Eu Sap Blogs

3 Simple Ways To Find A Company S Vat Number Wikihow

3 Simple Ways To Find A Company S Vat Number Wikihow

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Company Registration Number What Is It

Company Registration Number What Is It