1099 Vs Business License

This post will go into the detail of each employment type and which is better for businesses. Independent Contractors on the other hand are usually provided with a completed copy of IRS Form 1099-MISC Opens in new window by the business that paid them.

If you are hiring an independent contractor you need a 1099 form.

1099 vs business license. The annual renewal fee is 500 for Corporations and 200 for all other business entity types. 1099-Misc Income as business income. The requirements and fees vary based on your business activities location and government rules.

As always there are both advantages and disadvantages to hiring 1099 workers. Employers have limited control over independent contractors who follow their own schedules and work patterns. Most states arent this fussy but they do require people in certain occupations -- such as doctors lawyers nurses and architects -- to get a state license.

As long as a 1099 contractor is meeting their deadlines and obligations an employer has no business saying how and when the work should be done. My son is a full time undergrad and did internship in 2016. From catering to cupcake baking crafting homemade jewelry to glass blowing -- no matter what a persons passion the Internal Revenue Service offers some tips on hobbies.

Whether you hire a 1099 contractor boils down to your business objectives and goals. Turbotax calculates federal tax due for income from Internship non-employee compensation on 1099-Misc by treating this as a business income. It is required to be filed by the business for whom services were performed if payments to an independent contractor during the calendar year total 600 or more.

Business owners can also generate and file W-2s through Square Payroll. If your business needs are more ongoing a W-2 employee may be the way to go. Whats more being paid based on a 1099 also will not automatically classify you as an independent contractor.

1099 vs W2 workers have their own unique sets of pros and cons. The fee and renewal form are due on the last day of the anniversary month in which the license was originally filed. Thats because your employees will be receiving a W-2 tax form rather than a 1099 tax form which is specifically designed for independent contractors.

The W-2 form is available on the IRS website. A business license is a permit from your local government authorizing you to operate in its jurisdiction. Form 1099 comes in various versions depending on the payment type.

The answer depends on where you work and what you do. These two designations are talking about the same business and the differences are really only are relevant to how income is received so you can be both. A few states -- including Alaska and Washington -- require all businesses to get a state business license.

Most small businesses need a combination of licenses and permits from both federal and state agencies. The Consequences of Operating Without a Business License. Does an Independent Contractor Need a Business License.

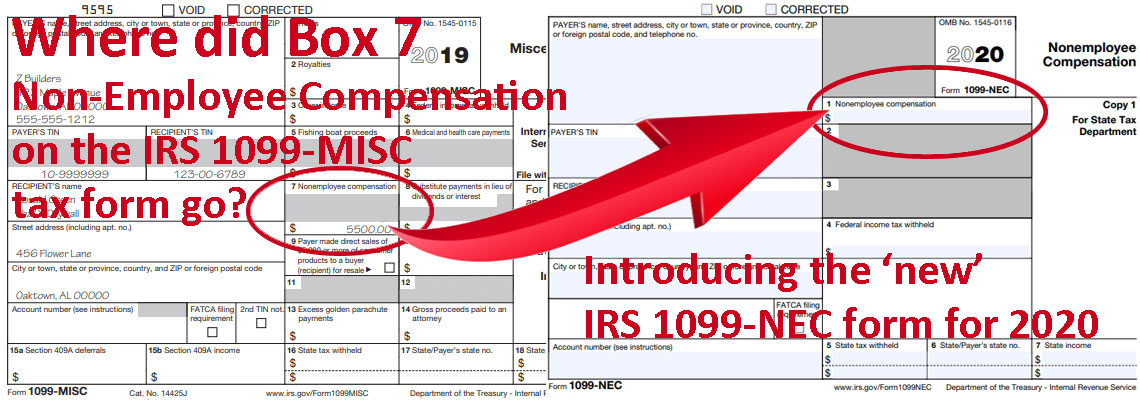

Conversely full time and part time employees are nicknamed W-2ers as their incomes are recorded on form W-2. IRS Small Business Week Tax Tip 2017-04 May 3 2017 Millions of people enjoy hobbies that are also a source of income. Form 1099-MISC or 1099-NEC is an annual information return listing the gross amount of payments made to an independent contractor.

This payment would have been for services performed by a person or company who IS NOT the payors employee. If you need just one or two specialized projects completed a contractor may be a good fit. The 1099 form is officially known as a 1099-MISC form with misc standing for miscellaneous.

What is the State Business License annual renewal fee and when is it due. For this reason many people refer to independent contractors as 1099 workers and traditional employees as W-2 employees in the context of taxes. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor.

Form 1099-MISC is paperwork that. Independent contractor vs LLC refers to the differences between an independent contractor and a limited liability company. What Is an Independent Contractor.

Businesses will now file Form 1099-NEC for each person in the course of the payors business to whom they paid at least 600 during the year. While these specific regulations are issued by the state of California many other states have similar rules governing the employer-employee relationship. It can be required of you if you paid someone 600 or more during the tax year.

1099 employees can work remotely as long as they meet their contractual obligations. Both are business types but an independent contractor is comprised of one person or member while an LLC can have one or more members. For example a sole proprietor might receive 1099 income from a contracting employer and also receive other business income from sales of a product or service.

You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. Instructions to Form 1099-NEC 1099. A 1099 form is a series of documents used by businesses to report payments made to.

While some states require all businesses to have a license others may require it depending on what kind of work you do.

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

The Most Common 1099 Tax Deductions For Independent Contractors In 2019 Money Mimosas Tax Deductions Deduction Tax Deductions List

The Most Common 1099 Tax Deductions For Independent Contractors In 2019 Money Mimosas Tax Deductions Deduction Tax Deductions List

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Irs 1099 Misc Vs 1099 Nec Inform Decisions

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

Irs Approved 1099 K Tax Forms File Form 1099 K When Working With Payment Card And Third Party Network Transactions A Payment Settleme Tax Forms W2 Forms Form

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

Tax Deductions Write Offs Self Employed Entrepreneur Creative Entrepreneur Business Tax Deductions Small Business Tax Business Tax

Tax Deductions Write Offs Self Employed Entrepreneur Creative Entrepreneur Business Tax Deductions Small Business Tax Business Tax

Cleaning Service Business License You Will Need To Check With Your State To See If They Require A Business License Cleaning Service Cleaning Cleaning Business

Cleaning Service Business License You Will Need To Check With Your State To See If They Require A Business License Cleaning Service Cleaning Cleaning Business

1099 Form 2016 Download Instructions For Form 1099 Ltc 2016 Printable Pdf Form Job Application Form Fillable Forms

1099 Form 2016 Download Instructions For Form 1099 Ltc 2016 Printable Pdf Form Job Application Form Fillable Forms

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Do You Have To Carry Workman S Comp Insurance On 1099 Contractors Workers Compensation Insurance Contractors General Contractor Business

Do You Have To Carry Workman S Comp Insurance On 1099 Contractors Workers Compensation Insurance Contractors General Contractor Business

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law

Utah Business Corporate Law Attorney Coulter Law Group Business Law Business Tax Small Business Law