How To Find My 1099-div

Where can I find the state listed for 1099-DIV andor 1099-INT. Multiply the amount in Box 1a of your Form 1099-DIV by the Foreign Source Income Percentage in the tables that follow.

Breaking Down Form 1099 Div Novel Investor

Breaking Down Form 1099 Div Novel Investor

Youll receive a Form 1099-DIV this year if you earned 10 or more in dividends or capital gains from your mutual fund holdings.

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg)

How to find my 1099-div. Enter any qualified dividends from box 1b on Form 1099-DIV on line 3a of Form 1040 Form 1040-SR or Form 1040-NR. Download Form 4852 Substitute for Form W-2 Wage and tax Statement or Form 1099-R Distribution from Pensions Annuities Retirement or Profit-sharing Plans IRAs Obtain phone assistance through 800-829-1040. The financial institution prepares the Form 1099-DIV and submits a copy to the IRS and a copy to the taxpayer.

The transcript should include all of the income that you had as long as it was reported to the IRS. Your income excluding net capital gain and qualified dividend income is taxed at or below the 24 income tax bracket and. Get them as soon as theyre available Remember that tax forms are always posted online as soon as theyre ready.

It might be listed in your year-end reports or a prospectus online. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS. Although tax-exempt interest dividends from Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund Admiral Shares are.

Take a look at the schedule for each tax form above You can also find your investment income and distributions on your year-end statement. Depending on your account activity your 1099 may include. An alternative to asking an issuer for a Form 1099 is to get a transcript of your account from the IRS.

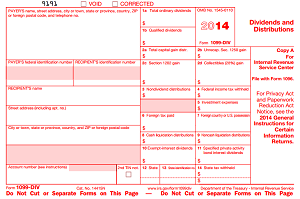

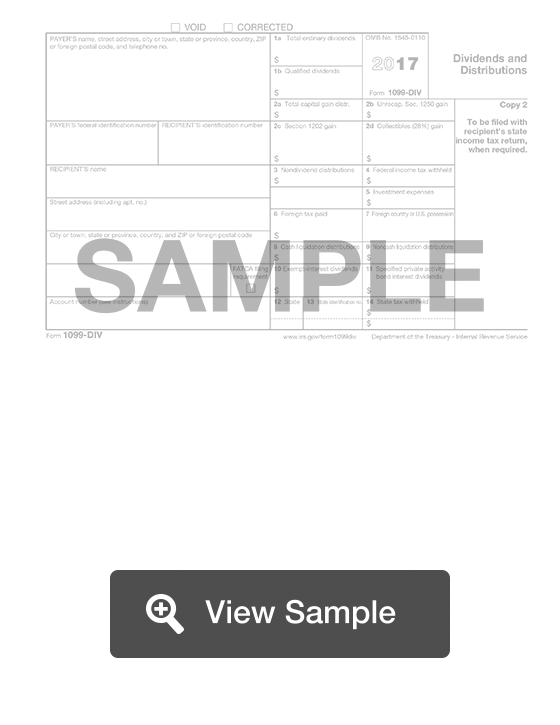

Form 1099-DIV is a record that financial institutions send to investors the IRS to report dividends and distributions. If you are not sure if you have interest or dividends to report contact your bank or financial institution and check on the account statements that you have received. Heres how it works how to use it.

Box 1b reports the portion of box 1a that is considered to be qualified dividends. It should show all Forms 1099 issued under your. If you are looking for 1099s from earlier years you can contact the IRS and order a wage and income transcript.

Employee plan participants can find them in the Tax Forms and Documents section of Employee Online. All 1099-DIV and 1099-B forms are mailed out by mid-February at the latest. If your mutual fund investment makes a capital gain distribution to you it will be reported in box 2a.

You may not receive a 1099 form in the amount is less than 1000. Form 1099-DIV Dividend or 1099-INT Interest Income. You get them simply for owning a stock or fund on a certain date.

You can also access your tax forms digitally. If it is not listed right on the 1099DIV which it often is not then you would need to contact your broker or financial institution for more information about the funds investments. If your only capital gains and losses are from capital gain.

Your 1099-DIV lists any dividends you received exceeding 10 in the previous year. Companies provide a copy of the Form 1099-DIV to the investor and to the IRS. Most investors who receive a Form 1099-DIV will have ordinary dividends qualified dividends or total capital gains.

For distributions of less than 10 refer to your year-end account statement. You can check to see what dividends you received by visiting the Recent Activity section of your Acorns Investment accounts. Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive.

These include stocks mutual funds and exchange traded funds ETFs. Click the button I earned interest exempt dividends in more than one state and then in the first State box use the drop down to select Multiple States and put the entire amount from box 11 in the box next to that selection. You should use this method if.

You can view your last statement s of the year to determine if you have earned 1000 or more in interest dividends or distribution s from retirement accounts. You can check on your tax forms anytime youre logged on to your account. To 7 pm Monday-Friday your local time - except Alaska and Hawaii which are Pacific time.

For more information see. Dividends are companies ways of thanking you for investing with them. All reportable income and transactions for the year.

Say Thanks by clicking the thumb icon in a post. What is form 1099-OID. Hours of operation are 7 am.

Depending on your activity and portfolio you may get your form earlier. Form 1099-DIV exists so that taxpayers and the IRS know the income generated by financial assets in dividend paying accounts. Form 1099-B Form 1099-DIV Form 1099-INT Form 1099-MISC and Form 1099-OID.

If you have an amount entered in other boxes of your Form 1099-DIV refer to the Instructions for Recipient of Form 1099-DIV that are attached to your form and the Instructions for Schedule D to see where to report them.

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Student Loan Interest Tax

Where Are My Tax Forms Due Dates For Forms W 2 1099 1098 More Tax Forms Student Loan Interest Tax

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

Tax Forms Every Investor Should Know About Novel Investor

Tax Forms Every Investor Should Know About Novel Investor

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Form 1099 Div Dividends Deductions Fill Out Online Formswift

Form 1099 Div Dividends Deductions Fill Out Online Formswift

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Like Dividends How To Read Your 1099 Div Nasdaq

Like Dividends How To Read Your 1099 Div Nasdaq

Schwab Moneywise Calculators Tools Understanding Form 1099

Schwab Moneywise Calculators Tools Understanding Form 1099

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Like Dividends How To Read Your 1099 Div Nasdaq

Like Dividends How To Read Your 1099 Div Nasdaq

How To Print And File 1099 Div Dividends And Distributions

How To Print And File 1099 Div Dividends And Distributions

What Is A C Corporation What You Need To Know About C Corps Gusto

What Is A C Corporation What You Need To Know About C Corps Gusto

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Letter Of Employment Tax Forms 1099 Tax Form

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Letter Of Employment Tax Forms 1099 Tax Form

/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition