How To Apply For Absa Loan Online

Register for Absa Online to get started. Absa Online the Absa Banking App and Cellphone Banking.

Absa Home Loan Review 2020 Home Loans First Time Home Buyers Loan

Absa Home Loan Review 2020 Home Loans First Time Home Buyers Loan

All you need to do is logon to Absa online and click on apply on the top tabbed navigation and fill in your requirements and you could have the money in your account in 10 minutes.

How to apply for absa loan online. Enter your requirements and you could have the money in your account in less than 10 minutes. Alternatively you can apply at your institutions student bureau. You will be required to have the following supporting documentation on hand for your application.

Check how much your next payment is. As we said you will not be asked any kind of document. Loan applications are now available on our digital channels.

Be 18 years or older. A You are not a minor. Support to corporate and business banking clients will entail solutions based on.

December 9 2020 by admin 72 0 0. Fill in the quick and easy form. Providing a seamless banking service to our customers remains a high priority.

Calculate your estimated total costs of our Instant Loan. View your transaction history. Earn a regular monthly income of at least R2 000 per month.

There are several ways that you can apply for the ABSA Instant Personal Loan you can apply using one of the bellow methods. The loan is open to all South African citizens who permanently live in South Africa and earn more than R3000 per month. View your home loan account details.

Applying for an Absa instant loan online is super easy. Existing Absa customers can simply log on to Absa online and click Apply Select Personal Loan from the menu. A valid identification document such as a passport or national identity card.

Completed loan application form. Before you start please accept the terms and conditions. Are Repayments high for Absa Instant Loan.

You simply need to visit your nearest branch and provide us with the following documents. C You are not subject to an administration order. For new Absa customers.

Parents Guardians Identify Document minors only Proof of tertiary registraion or acceptance. Cellphone Banking dial 1202272 What are the requirements to applying for ABSA Instant Personal Loan. This loan is covers a wide variety of study related expenses and must be repaid with interest.

B You have never been declared mentally unfit by a court. Absa offers a study loan to students who wish to fund their tertiary education. Have a bank account into which your income is paid.

A revolving credit is a loan facility that continuously revolves. You want to swipe up and boom. You can now apply for a ABSA Personal Loan online through all ABSA digital platforms which include Absa Online Banking the Absa Banking App and Cellphone Banking.

The loan can be taken out by the following individuals with proof of income. A letter from your employer confirming your employment if you have been employed for less than one year. Yes youre smiling because you know its true.

Online banking allows you to. National photo ID card or passport for non-Ghanaians Completed loan application form. Easily Apply Online for a ABSA Personal Loan.

Manage your debit orders. Applying for an Absa Personal Loan is straightforward. If you qualify for the loan you will be approved right there.

Apply online by visiting wwwabsacoza. This new generation of young people is used to do everything online and is not comfortable with waiting. A once-off initiation fee of 10 will apply excl.

Credit protection will cover you in case of death and is available from Absa. But lets get serious. Your latest salary slip.

You can use your online banking profile to securely manage your home loan 247. Absa offers a study loan to students who wish to fund their tertiary education. VAT The amount to repay within 35 days for an instant loan taken for R550 at an initiation fee of 10 would be R55 excl.

To apply for a personal loan over 12 months or more you need to. The best way to apply is by visiting your nearest Absa branch. As our client you confirm that.

Terms and conditions apply. How To Apply And Requirements For A Absa Personal Loan To apply you must be permanently employed and over the age of 18 Existing ABSA clients can apply online. The facility does not have a maximum loan.

All you will need is enter your bank account online and request the loan. How the Absa Personal Loan Application works. Our personal loan could be the quickest and easiest way.

Call us 0860 669 669. This loan is covers a wide variety of study related expenses and must be repayed with interest. A personal loan application that is quick and flexible.

For this loan no paperwork is required but you must at least meet the following requirements. Bank statements for 6 months certified Please note that Absa Direct Personal Loans and Employee Salary Overdrafts are available if youve had a salaried account with Absa for at least 6 months. Taking out a loan is not the same as buying a new cellphone over the Internet.

How do I Apply for an Absa Student Loan. You can apply for a facility between the amount of R15 000 and R150 000. The loan is open to all South African citizens who permanently live in.

Check your home loan balance. Crucially this programme will not attract additional administration fees for customers. These relief measures apply to Absas corporate wealth business bank private bank and retail customers.

Absa Car Finance Buy A Repossessed Car Car Finance Finance Solutions

Absa Car Finance Buy A Repossessed Car Car Finance Finance Solutions

Absa Evolve Pay As You Transact Business Account Review 2021 In 2021 Business Account Accounting Banking App

Absa Evolve Pay As You Transact Business Account Review 2021 In 2021 Business Account Accounting Banking App

Absa Business Evolve Zero Account Fees 2021 In 2021 Accounting Visa Debit Card Create Invoice

Absa Business Evolve Zero Account Fees 2021 In 2021 Accounting Visa Debit Card Create Invoice

Absa Uganda Apps On Google Play

Absa Gold Graduate Account Review 2021 Credit Card Benefits Credit Card Charges Credit Card Fees

Absa Gold Graduate Account Review 2021 Credit Card Benefits Credit Card Charges Credit Card Fees

Pin On Banking In South Africa

Pin On Banking In South Africa

Pin By Terry Bahati On Temporary Cash Management How To Plan Online Share Trading

Pin By Terry Bahati On Temporary Cash Management How To Plan Online Share Trading

Absa Zambia Internet Banking Guide How To Use Barclays Bank Online Banking Online Banking Banking Banking Services

Absa Zambia Internet Banking Guide How To Use Barclays Bank Online Banking Online Banking Banking Banking Services

Absa Islamic Premium Banking Account Review 2021 In 2021 Private Banking Banking Banking Services

Absa Islamic Premium Banking Account Review 2021 In 2021 Private Banking Banking Banking Services

Absa Private Banking Account Review 2021 Private Banking Online Share Trading Banking

Absa Private Banking Account Review 2021 Private Banking Online Share Trading Banking

Absa Premium Credit Card Moneytoday Credit Card Credit Card Application Gold Credit Card

Absa Premium Credit Card Moneytoday Credit Card Credit Card Application Gold Credit Card

The Absa Trusave Savings Account Is A Entry Level Product With Instant Access That Is Perfect For Some Investment Accounts Tax Free Investments Savings Account

The Absa Trusave Savings Account Is A Entry Level Product With Instant Access That Is Perfect For Some Investment Accounts Tax Free Investments Savings Account

Thanks To Absa For Your Sponsorship We Appreciate Your Support Visit Them On Www Absa Co Za Tmsa17 Tmsasponsor Opening A Bank Account Thankful Banking

Thanks To Absa For Your Sponsorship We Appreciate Your Support Visit Them On Www Absa Co Za Tmsa17 Tmsasponsor Opening A Bank Account Thankful Banking

Absa Bank Mauritius Limited Wikipedia

Absa Bank Mauritius Limited Wikipedia

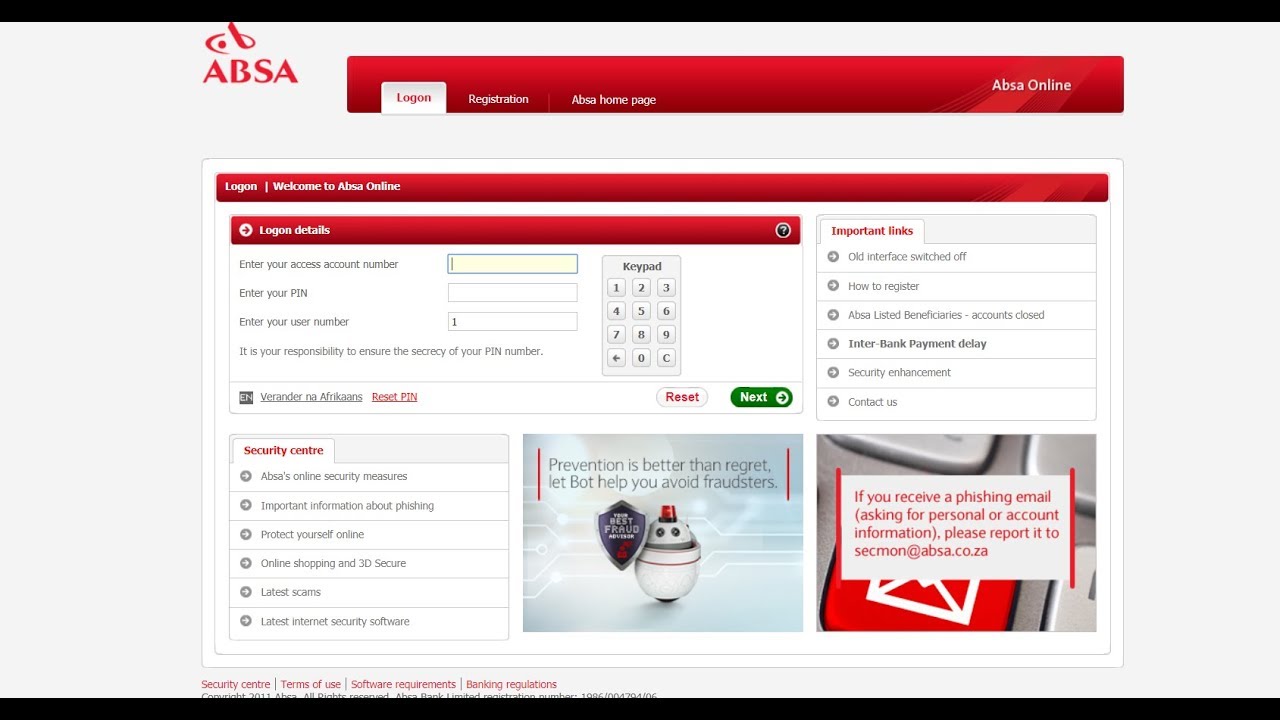

Absa Online Banking Login Steps Online Bank Login Tutorial Youtube

Absa Online Banking Login Steps Online Bank Login Tutorial Youtube

How To Contact Absa Customer Care In Botswana Follow This Service Guide Customer Care Reading Recommendations Service

How To Contact Absa Customer Care In Botswana Follow This Service Guide Customer Care Reading Recommendations Service

Absa Flexi Core Credit Card Review 2021 In 2021 Credit Facility Credit Card Benefits Credit Card Fees

Absa Flexi Core Credit Card Review 2021 In 2021 Credit Facility Credit Card Benefits Credit Card Fees

Universal Branch Codes Absa Fnb Nedbank Standard Bank Online Tutoring Jobs Tutoring Jobs Online Tutoring

Universal Branch Codes Absa Fnb Nedbank Standard Bank Online Tutoring Jobs Tutoring Jobs Online Tutoring