How To Request A New 1099 G Form

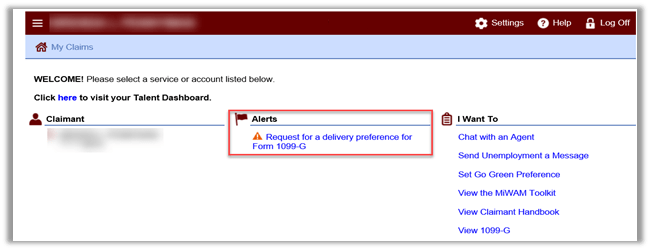

Review IRS tax guidance on benefit identity theft. 1099Gs are available to view and print online through our Individual Online Services.

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

We do not mail these forms.

How to request a new 1099 g form. The New Mexico Department of Workforce Solutions mails all Unemployment Insurance 1099 tax information by the last day of January each year. Information about Form 1099-G Certain Government Payments Info Copy Only including recent updates related forms and instructions on how to file. Visit the Department of Labors website.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. Please fill out the following form to request a new 1099 form. Individuals can access copies of 1099 forms by logging into the UI Tax Claims System wwwjobsstatenmus Sunday through Friday from 400 am.

You can view 1099-G forms for the past 6 years. If we find you were a victim of fraud we will remove the claim from your Social Security number and send you an updated 1099G. If you received PUA benefits as well as regular state unemployment benefits PEUC or SEB the 1099-G form in your MyUI.

These forms will be mailed to the address that DES has on file for you. Anyone who repaid an overpayment of unemployment benefits to the State of Arizona in 2020 will also receive a 1099-G form. Taxpayers and practitioners can access an electronic version of Forms 1099-G via the Personal Income Tax e-Services Center.

Select Unemployment Services and ViewPrint 1099-G. Log in to your NYGov ID account. 3 Under Delivery Preference for Form 1099-G click Electronic.

1099-G information will also be available from the Check Claim Status tool no later than January. Federal state or local governments file Form 1099-G if they made certain payments or if they received Commodity Credit Corporation loan payments. Your email address will be displayed.

Visit Ask EDD and select the Form 1099G category or call 1-866-401-2849 during regular business hours. Once NYSDOL receives your completed Request for 1099-G Review form it will be reviewed and we will send you an amended 1099-G tax. I cant file my taxes until I get my 1099 G form and cant get any help to resolve this matter.

If we have your email address on file we have sent you via email the information for your 1099-G for 2020. Contact the DUA Interactive Voice Response IVR at 617 626-5647 and follow the prompts to. Click on View and request 1099-G on the left navigation bar.

Taxpayers who are unable to obtain a timely corrected form from states should still file an accurate tax return reporting only the income they received. For Pandemic Unemployment Assistance PUA claimants the. Federal Form 1099-G Certain Government Payments is filed with the Internal Revenue Service IRS by New York State for each recipient of a New York State income tax refund of 10 or more.

To view and print your statement login below. Click on the down arrow to select the right year. Click on View 1099-G and print the page.

You must complete all fields to have your request processed. You may send the form back to NYSDOL via your online account by fax or by mail. 1 Log into MiWAM.

A 1099G is issued if you received 10 or more in gross unemployment insurance payments. If you disagree with any of the information provided on your 1099-G tax form you should complete the Request for 1099-G Review. If you have a 1099 discrepancy call the NMDWS 1099G informational and message line at 505.

4 - Review and Submit. Lost my pandemic unemployment 1099G form and unable to reset password request copy onlinehow can I resolve this issue in order to file my income tax return. To access a Form 1099-G electronically a taxpayer must first register for an e-signature account by establishing a User ID and Password.

Form 1099-G for New Jersey Income Tax refunds is only accessible online. To determine if you are required to report this information on a federal income tax return see the federal income tax instructions contact the IRS or contact your tax professional. If you received only regular state unemployment benefits Pandemic Emergency Unemployment Compensation PEUC or State Extended Benefits SEB during 2020 you should complete the Request Replacement 1099-G Form to request a copy of your 1099-G form by mail.

Follow the instructions on the bottom of the form. Similarly if you were paid for 2020 weeks in 2021 those will not be on your 1099-G for 2020 they will appear on your 1099-G for 2021. Unemployment benefits they did not receive to contact the issuing state agency to request a revised Form 1099-G showing they did not receive the benefits.

If you are requesting your 1099G to be sent to another address than what we have on file you will be required to submit proof. Florida Department of Economic Opportunity 1099-G Request Form. To receive your 1099-G online.

You can elect to be removed from the next years mailing by signing up for email notification. You will receive an email acknowledging your delivery preference. 2 Under Account Alerts click Please select a delivery preference for your 1099 Form.

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

Unemployment Insurance Tax Information Rhode Island Department Of Labor And Training

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1099 G Fill Online Printable Fillable Blank Pdffiller

Florida Residents Report Problems Accessing 1099 G Form Youtube

Florida Residents Report Problems Accessing 1099 G Form Youtube

1099 G Form Copy B Recipient Discount Tax Forms

1099 G Form Copy B Recipient Discount Tax Forms

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

All You Need To Know About The 1099 Form 2020 2021

All You Need To Know About The 1099 Form 2020 2021

1099 G Tax Form Why It S Important

1099 G Tax Form Why It S Important

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Faqs Benefits Kansas Department Of Labor

Faqs Benefits Kansas Department Of Labor

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

Labor And Economic Opportunity How To Request Your 1099 G

Labor And Economic Opportunity How To Request Your 1099 G

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

1099 Form Available For 2017 Unemployment Recipients

1099 Form Available For 2017 Unemployment Recipients