How To Check Vat Registration In Uae

VAT Registration UAE refers to the set of procedures by which a person can register with the Federal Tax Authority FTA. What is VAT registration number.

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

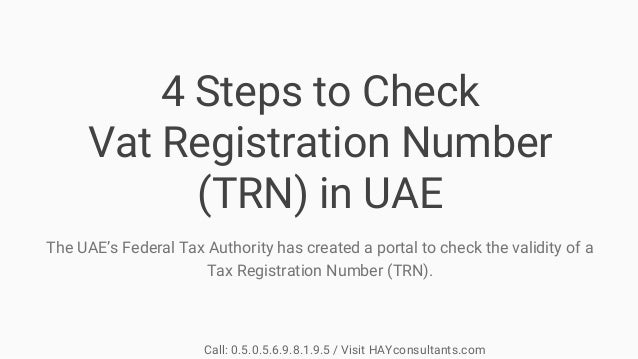

How to check TRN validity in UAE.

How to check vat registration in uae. It is mandatory that only persons having a valid TRN should charge VAT on supplies. The process for de-registering under VAT is shown below. Xact Auditing is offering VAT registration services and Tax Group registration services.

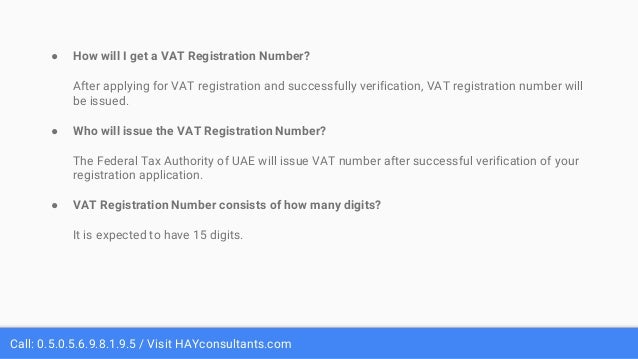

Submit the application as per the guidance provided in the form. For general inquiries about tax registration andor application you may contact Federal Tax Authority through the enquiry form or send an email to infotaxgovae. Upon the approval of the application for UAE VAT registration a registered business will be supplied with a unique tax registration number TRN.

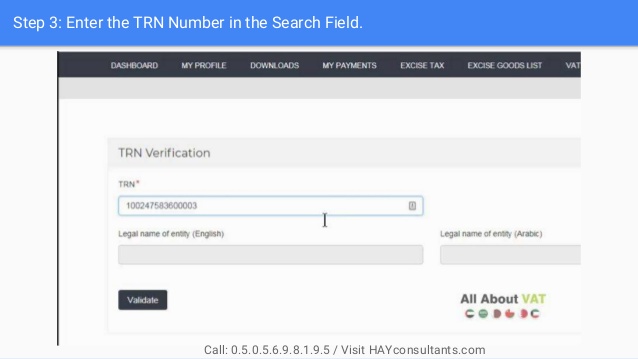

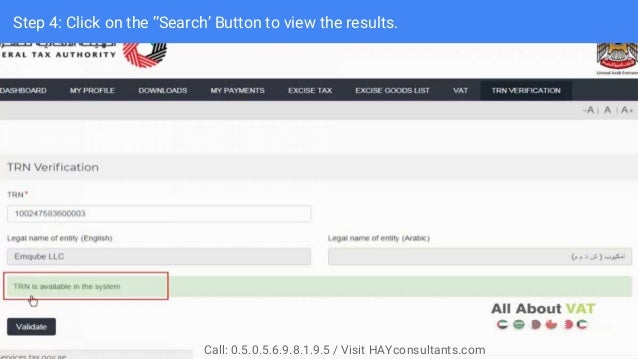

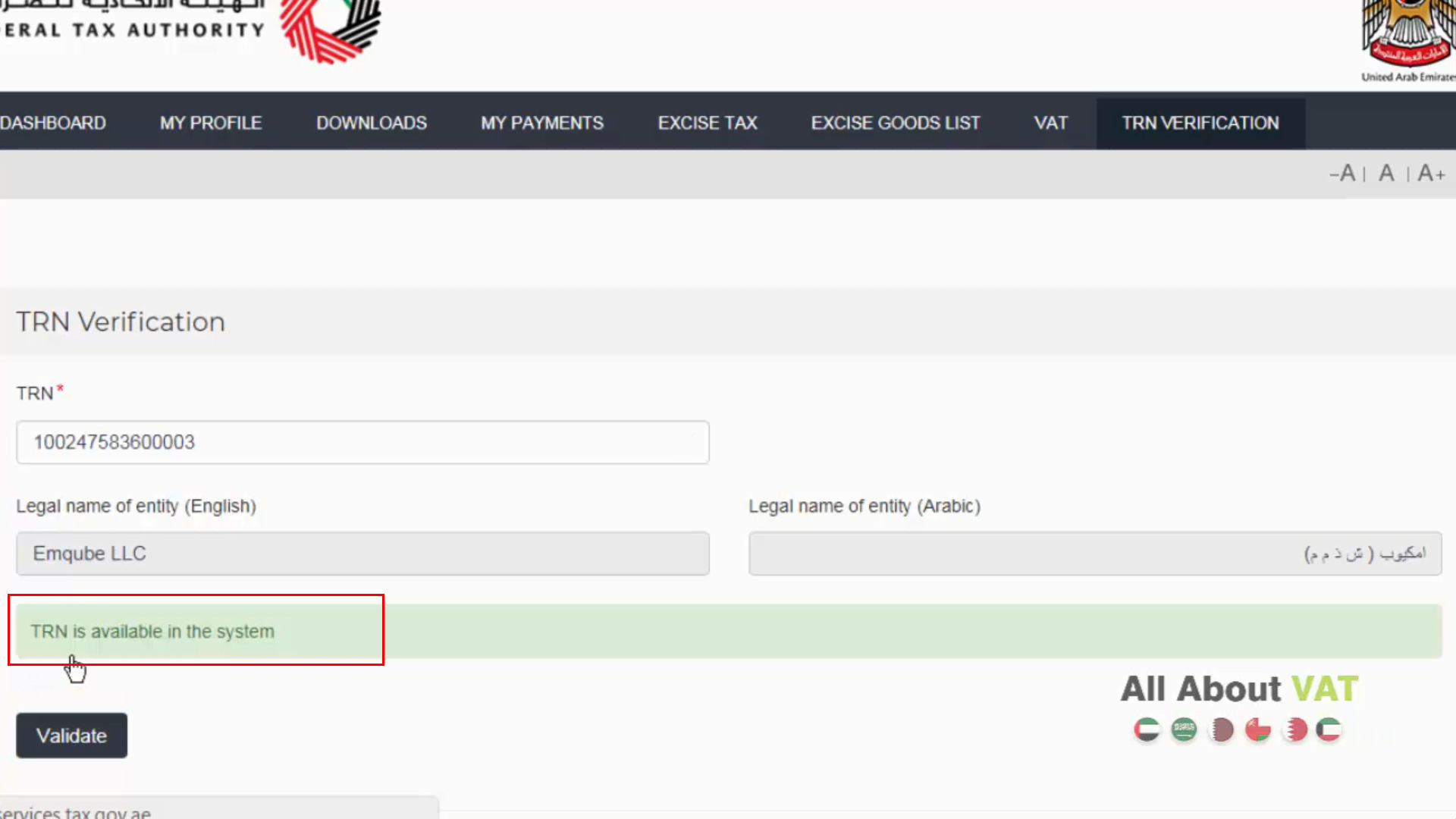

Enter the TRN number to be verified. For more details about VAT registration please read VAT registration User Guide PDF. TRN Tax Registration Number is the identification number given to every person registered under UAE VAT.

Visit the Official Portal of Federal Tax Authority. The VAT registration process in the UAE is a simple two-step process. How to check vat registration number trn in uae.

How to apply for VAT registration in the UAE. Unregistered businesses in the United Arab Emirates may register for Value Added Tax via the online portal on the Federal Tax Authority. VAT Voluntary Disclosure Form by FTA Form 211.

It is necessary for you to know how to calculate VAT in UAE using our UAE VAT calculator. This is called mandatory tax de-registration. First you need to add the total amount and then mention the VAT percentage.

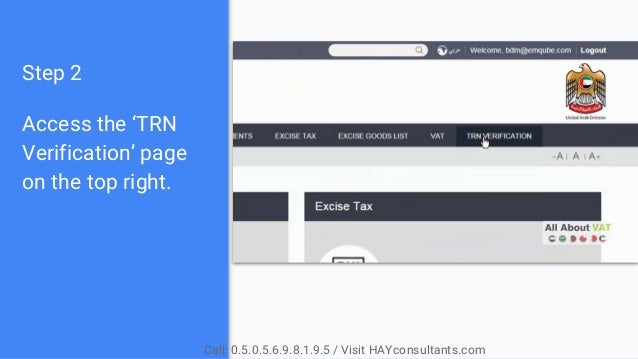

Look for the TRN VERIFICATION tab on the right side. Our online VAT calculator in Dubai gives you the flexibility of adding any VAT percentage you want but as per the current VAT Laws in UAE the standard rate of VAT is 5. Once the application is submitted the Federal Tax Authority FTA will review the application and may approve the application if all the condition for VAT registration is met.

FTA VAT in UAE VAT certificate. The country is developing into a premier business. Company registration in Dubai be it online or offline is a smart decision nonetheless.

Voluntary disclosure form 211 in UAE helps a taxable person to make correction in the errors they have committed while submitting a VAT. The FTA can cancel a persons registration if it is found that the registrant satisfies either of the 2 conditions listed above for de-registration. When can a registration be cancelled by the FTA in UAE.

MoF issues two types of tax certificates for eligible private sector companies working in the UAE namely. The TRN will be shown in all VAT invoices. Any person natural or otherwise can apply for VAT Registration or Excise Tax Registration in the UAE if they satisfy certain conditions.

A business must apply for VAT registration if the taxable supplies and imports exceed the mandatory registration threshold of AED 375000. VAT Registration in UAE. Hence VAT de-registration is a.

At this stage the name of the company associated with the. The VAT registration process happens online but there are some documents that you have to upload to the application for the Federal Tax Authority FTA to review for approval. According to tax regulations in UAE VAT registration has to be done by businesses if they reach the mandatory VAT registration threshold of Dh 375000.

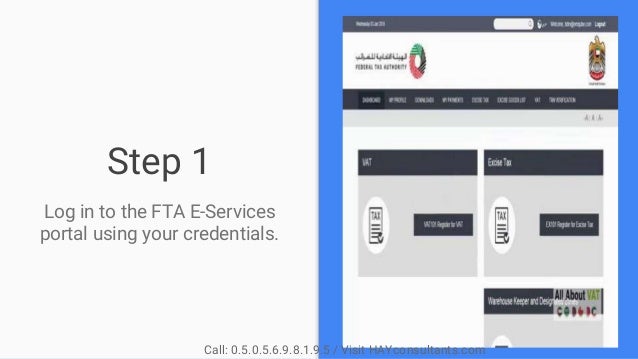

Visit web site of Federal Tax Authority in United Arab Emirates wwwtaxgovae. Seek for the TRN Verification option present in the. Some of these required pieces have to get submitted in Arabic and if you dont include all the required documents you could find your acceptance slowed down for unnecessary.

Online VAT registration in UAE is available on the Federal Tax Authority web portal to get the Tax Registration Number TRN. A voluntary disclosure is a form provided by Federal Tax Authority FTA to allow businesses and taxpayers to notify FTA about the errorsmistakes and omissionchanges in a Tax return or Tax Refund. About Vat Registration Number Call.

In such a scenario it is helpful for registered businesses to ensure that they receive supplies from a registered person so that they can recover the input tax on the supply fearlessly. Login to the website with the credentials Click here to register a new account in case. VAT registration application form can be accessed and provide all required information and documents.

The first step is setting up an e-service account and the next is logging into the new account and completing the VAT registration. The Certificate of Status of Business Business Personand the Tax Domicile Certificate to exempt them from Certificate of Status of Business Business Person and to enable them to take advantage of double taxation avoidance agreements signed by the UAE. Status of VAT registration application can be checked through 1Log into e-service account to check registration status 2Go to dashboard tab and see next to the status 3The status can be Drafted Pending Issued Suspended Rejected Approved.

Steps to Check if a TRN is Valid or not.

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

Guidelines For Vat Registration Calculation Reporting Vat Number Registration Vat In Uae Business Entrepreneur

Guidelines For Vat Registration Calculation Reporting Vat Number Registration Vat In Uae Business Entrepreneur

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Validity Of Tax Registration Number In Uae

How To Check Validity Of Tax Registration Number In Uae

Tax Registration Number Trn In Uae Complete Guide Techyloud

Tax Registration Number Trn In Uae Complete Guide Techyloud

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

Need To Register For Vat In Uae Check Your Business Have More Than 187 500 Aed As Taxable Supplies And Imports To Make Up With Fu Vat In Uae Dubai Accounting

Need To Register For Vat In Uae Check Your Business Have More Than 187 500 Aed As Taxable Supplies And Imports To Make Up With Fu Vat In Uae Dubai Accounting

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

Tax Registration Number Trn In Uae Complete Guide Techyloud

Tax Registration Number Trn In Uae Complete Guide Techyloud

Do You Require Obtaining The Vat Registration In Bahrain Check The Vat Registration Criteria In Bahrain Accounting Software Best Accounting Software Job Ads

Do You Require Obtaining The Vat Registration In Bahrain Check The Vat Registration Criteria In Bahrain Accounting Software Best Accounting Software Job Ads

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae

How To Check Vat Registration Number Trn In Uae