Does Your Employer Have To Give You A W2

If you dont receive your W-2 by the W-2 Form Deadline ask your employer for it. Register to Use Business Services Online.

2020 H R Bock Review The Best Free Option For Tax Filing Filing Taxes Hr Block Free Tax Filing

2020 H R Bock Review The Best Free Option For Tax Filing Filing Taxes Hr Block Free Tax Filing

Okay but when do employers have to give W-2 forms to employees.

Does your employer have to give you a w2. You may receive your W-2 electronically or by mail. Form W-2 Wage and Tax Statement shows your income and the taxes withheld from your pay for the year. Ask your employer for clarification on which delivery.

There is not a specific dollar amount limit. The IRS will contact your employer to issue W-2 Form that is missing. Employers must furnish these copies of Form W-2 to employees from whom.

It now rests on you to act fast so that you can pay your taxes as per the law and also get your refunds on time. So if your employer doesnt send your W2 in time then theres a problem brewing. As they are required to provide threaten them with this before you file.

Most of us have probably seen a W2 form before. What happens if your employer does not give you a W2. Instead the IRS just says the employer can charge a nominal amount.

Though your employer must give you a duplicate W-2 within a reasonable time the IRS does allow your employer to charge for the duplicate copies. It can come back to bite them if you file a substitute form and state that they wouldnt abide by your request. As an employer you need to complete a W-2 for each of your employees.

The IRS will send your boss a special form noting that you did not receive your W-2. If youre looking to obtain copies of your W-2 forms within this time period your employer should be able to send them to you within 30 days of your request. What can I do.

The forms must generally be given to employees by. Ask your employer or former employer for a copy. You can also check our database to find your W-2 onlineand have it.

Regarding the W-2 Form Deadline your employer should issue W-2 Forms to you no later than Jan. 31 each year or a few days later if the end of the month falls on a weekend. You need it to file an accurate tax return.

You will explain to the IRS that your former employer refused. Yes your employer is required legally to give you a W2 if he paid you 600 or more for the year. Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or Medicare tax was withheld for services performed by an employee must file a Form W-2 for each employee even if the employee is related to the employer from whom.

If you have not received your W2 at this point and have made an effort you will need to use your paystubs to complete a substitute W2. What happens if your employer doesnt give you a W2. The IRS will send you a letter with instructions and Form 4852 Substitute for Form W-2 Wage and Tax Statement or Form 1099-R Distributions from Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc.

- Answered by a verified Tax Professional. Employers must furnish Copies B C and 2 of Form W-2 to employees by January 31. Employers must file Copy A of Forms W-2 to the Social Security Administration by January 31st.

Instead of being an employee of the company you are employed by your own business or self-employed Youve probably received a 1099 tax form instead of a W-2. He must either give it to you by January 31st of each year or it must be postmarked to the last known address of yours by January 31st. Youll also send a copy to your city county or local tax agency.

I have a past employer that wont give me my w2. If you do not receive your W-2 by the end of February and you have already contacted your employer you can call the IRS for assistance at 800 829-1040. Single less than 2000.

Employers are required to issue W-2 Forms to employees by no later than Jan. Many employers choose to keep them longer just in case but the federal requirement when it comes to Copy D employer copy W-2 forms the general rule is a minimum of four years. The deadline for employers to send out W2s to their employees is January 31st.

Is your employer legally obligated to give you your W2 form. Depending on the types of workers they hire employers may be required by the Internal Revenue Service to give people who work for them W-2 forms. You must register to use Business Services Online Social Securitys suite of services that allows you to file W-2W-2Cs online and verify your employees names and Social Security numbers against our records.

The IRS will send your employer a letter requesting that they furnish you a corrected Form W-2 within ten days. Be sure they have your correct address. Many people are true independent contractors for example independent electricians or accountants who have many clients with whom they have business relationships.

If you havent received your form by mid-February heres what you should do. We use cookies to give you the best possible experience on our website. Youll send each employee a copy and submit all your W-2s to the Social Security Administration by January 31.

If January 31st falls on a Saturday Sunday or legal holiday the deadline will be the next business day. Federal law requires employers to send W- 2s to workers by Jan. Its what an employer sends its employees each year summarizing wages paid and taxes withheld and its a necessary document when it comes time to.

3 Form Quarterly Taxes The Biggest Contribution Of 3 Form Quarterly Taxes To Humanity Addition Words Tax Guide Employee Tax Forms

3 Form Quarterly Taxes The Biggest Contribution Of 3 Form Quarterly Taxes To Humanity Addition Words Tax Guide Employee Tax Forms

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Birth Certificate Template Money Template

W2 Fake Good Ein Printable Taxes Check Dependents Refund Template 2017 2018 Payroll Template Birth Certificate Template Money Template

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Download W 2 Form W 2 Employer Federal Copy A Printable Job Applications W2 Forms Employment Application

Download W 2 Form W 2 Employer Federal Copy A Printable Job Applications W2 Forms Employment Application

Everything You Need To Know 1099 Vs W2 Tax Season This Or That Questions Truck Driver

Everything You Need To Know 1099 Vs W2 Tax Season This Or That Questions Truck Driver

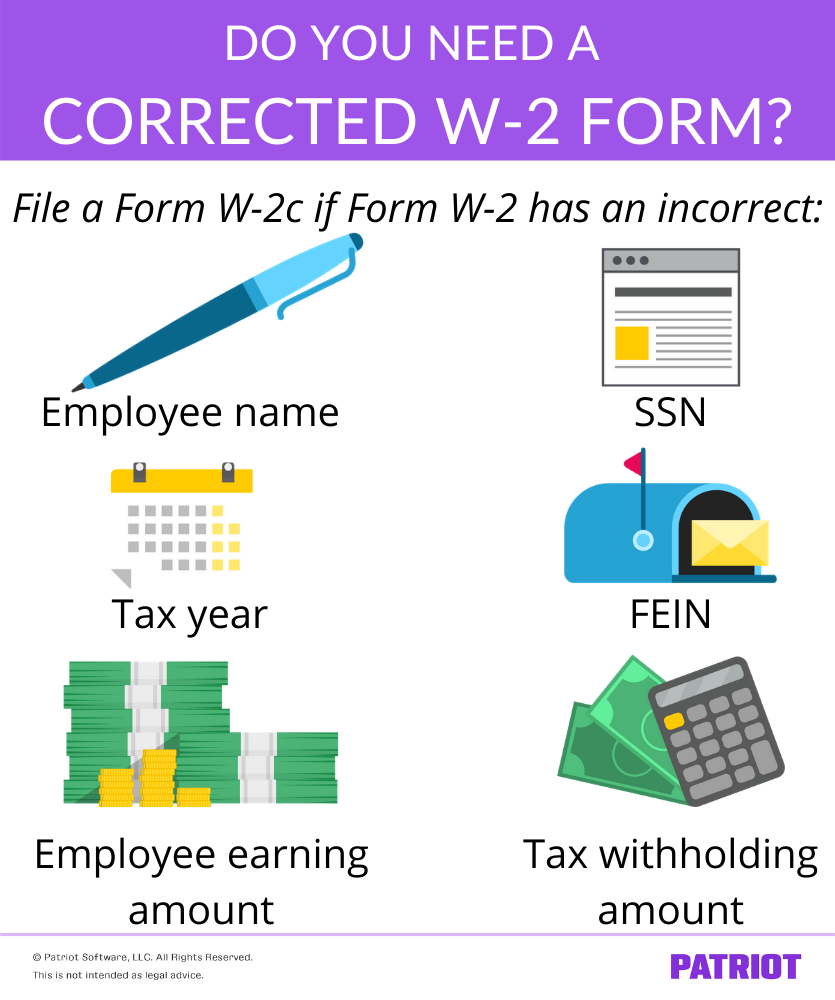

How To Correct A W 2 Form Irs Form W 2c Instructions

How To Correct A W 2 Form Irs Form W 2c Instructions

Wage Tax Statement Form W 2 What Is It Do You Need It

Wage Tax Statement Form W 2 What Is It Do You Need It

Form W 2 Explained William Mary

Form W 2 Explained William Mary

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms Income Tax W2 Forms

Form W2 Everything You Ever Wanted To Know

Form W2 Everything You Ever Wanted To Know

Pin By Paul Lionetti On Quick Saves In 2021 Internal Revenue Service Tax Forms Fillable Forms

Pin By Paul Lionetti On Quick Saves In 2021 Internal Revenue Service Tax Forms Fillable Forms

Form W2 Everything You Ever Wanted To Know

Form W2 Everything You Ever Wanted To Know

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs Payroll Taxes Payroll Tax Services

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs Payroll Taxes Payroll Tax Services

Missing Your W 2 Here S What To Do Liberty Tax Tax Services Miss You

Missing Your W 2 Here S What To Do Liberty Tax Tax Services Miss You

1099 Income Amazon Ebay And Google Give You A 1099 If You Earn Over 600 That Doesn T Mean You Don T Have To D Adsense Google Adsense Money Google Adsense

1099 Income Amazon Ebay And Google Give You A 1099 If You Earn Over 600 That Doesn T Mean You Don T Have To D Adsense Google Adsense Money Google Adsense

Form 4852 Nannies Are Required To File Taxes Whether The Parents Provide Them With A W 2 Or Not If The Parents Do Parenting Plan How To Plan Parent Resources

Form 4852 Nannies Are Required To File Taxes Whether The Parents Provide Them With A W 2 Or Not If The Parents Do Parenting Plan How To Plan Parent Resources