Does Paypal Issue 1099-misc

Banks PayPal and any other third-party payment processor are all required to issue 1099-K forms so you need to be on your toes and know where all of your income comes from and how your clients and customers pay you. Check out with PayPal and you can save.

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

You wont need to issue one for the payment made with your credit card.

Does paypal issue 1099-misc. What you received is considered self-employment income as the IRS considers you in business for yourself for that specific income. Clients may also issue IRS form 1099-MISC which is the form the client uses to report the income paid to the contractor. PayPal is considered a third-party merchant and they are required to issue their own 1099 forms called a 1099-K.

If my small business paid independent contractors or other businesses using PayPal or a credit card must we send them a 1099-MISC form for federal income tax purposes. If you paid the contractor via PayPal business you do not have to issue the contractor a 1099-NEC. Save 20 on TurboTax Self-Employed.

However if the contractor is subject to backup withholding you must issue the appropriate Form 1099 even if you pay them under 600 in a year. Then reconcile it all and make a note of what income is being double-reported. PayPal will issue one 1099K for your SSN or TIN and will total up all transactions for all PayPal accounts associated with that ID.

Does Paypal send out 1099-Misc Tax Forms. Then each will get a 1099-Misc from your company. Beginning with tax year 2011 the IRS requires you to exclude certain payment types you made to a 1099 vendor on Form 1099-MISC that will be included on third party payment processors such as credit card companies PayPal etc.

In short PayPal will issue Form 1099-K to your contractor. The 1099K has nothing to do with the eBay account or the or the PayPal account - it has to do with the taxpayer. The tax form will only be issued if the payment meets the other requirements for issuing a.

If you processed over 20000 in payment volume and you had 200 or more transactions PayPal and other payment settlement companies are required to send you a 1099-K in most states. You should get 1099 from Paypal sometime in Januaryif you meet 200 transactions and 20k in payment collected via goods and services. It you have collected 20k and 200 transactions under goods and servicesthis does not exclude refund and returns and chargebacksales tax it is gross amount.

So you do not need to send Form 1099-MISC. Both requirements must be metif you start selling in 2018it would be in the 1099k for 2018not 2017. So youll report it in the Business Income.

If you paid any of your contractors 600 or more each via Paypal Venmo Stipe Square etc. Select the tax year you need. It also provides a paper trail of the deductible expense for the client.

If you backup withhold you must issue a Form 1099 no matter what the payment amount was. Normally the minimum threshold for payments before you need to issue a 1099 is 600. Only those customers that meet the 1099-K eligibility requirements will see the 1099-K available for download in their account.

Payments made through PayPals friends and family option arent reported through the payment processor so youll need to issue them a 1099. Heres how you can access your tax Form 1099-K online from within your PayPal account. If you use the Friends and Family option for payment through PayPal or a similar option through Venmo or Wave you may need to issue a 1099-MISC for the payment.

TurboTax Self-Employed uncovers deductions personalized to you and your line of work. Where do i put income i received through paypal but no 1099-k or 1099-misc. Is there any change to the thresholds of 200 20K for 2019 behind us or new levels for 2020.

You are not required to send a 1099 form to independent contractors such as freelancers or to other unincorporated businesses such as LLCs if you paid them via PayPal or credit card. You can access your 1099-K from your PayPal account by January 31st annually. Click Statements and select Tax documents.

Include these payments as regular expenses and keep on hand verification of those payments email receipts etc. The only time they will get a. If you had less than 20000 and 200 or fewer transactions then you usually have to file the 1099-NEC Nonemployee Compensation.

Starting with the tax year 2020 Form 1099-NEC is replacing Form 1099-MISC for non-employee payments. If you cross the IRS thresholds in a given calendar year PayPal will send Form 1099-K to you and the IRS for that tax year the following year.

Am I Supposed To File This New 1099 Nec Form Or A 1099 Misc Form What Even Is The Difference Radical Profits Club

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Irs Forms

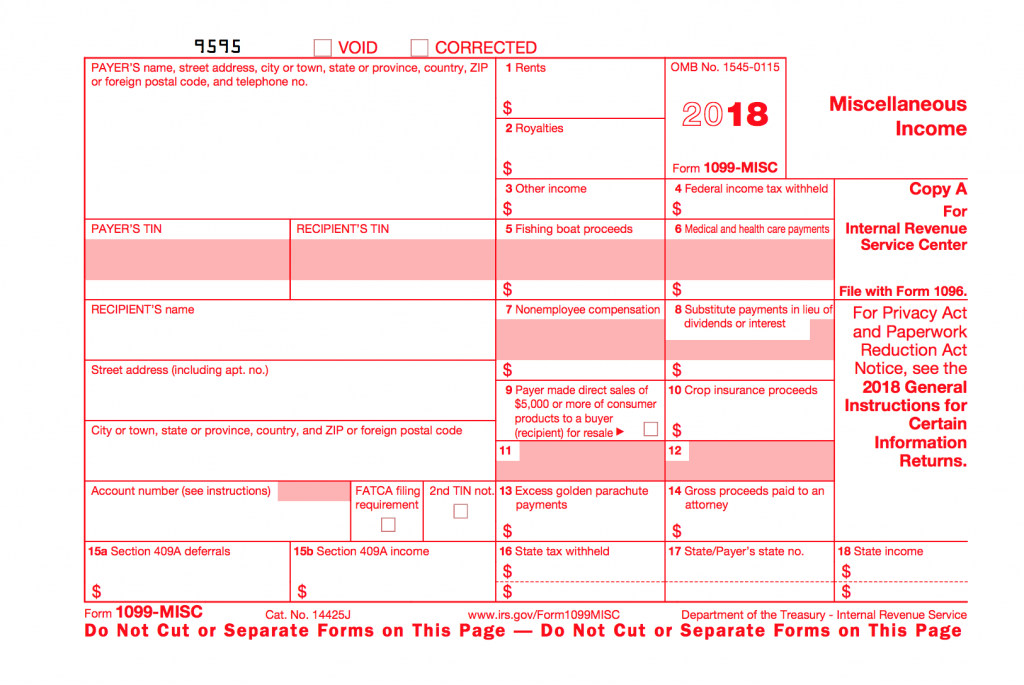

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

How Do You File 1099 Misc Wp1099

How Do You File 1099 Misc Wp1099

Do You Need To Issue A 1099 Misc Due

Do You Need To Issue A 1099 Misc Due

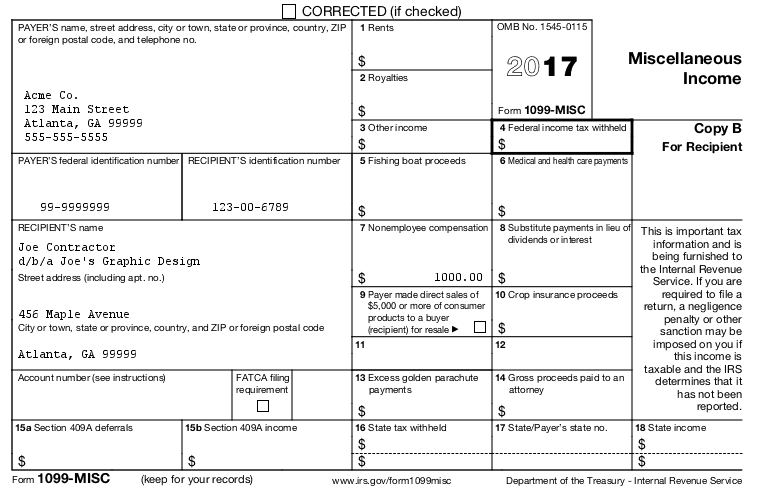

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

A Road Map For Who Gets A 1099 Misc Numbers In Boxes

A Road Map For Who Gets A 1099 Misc Numbers In Boxes

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

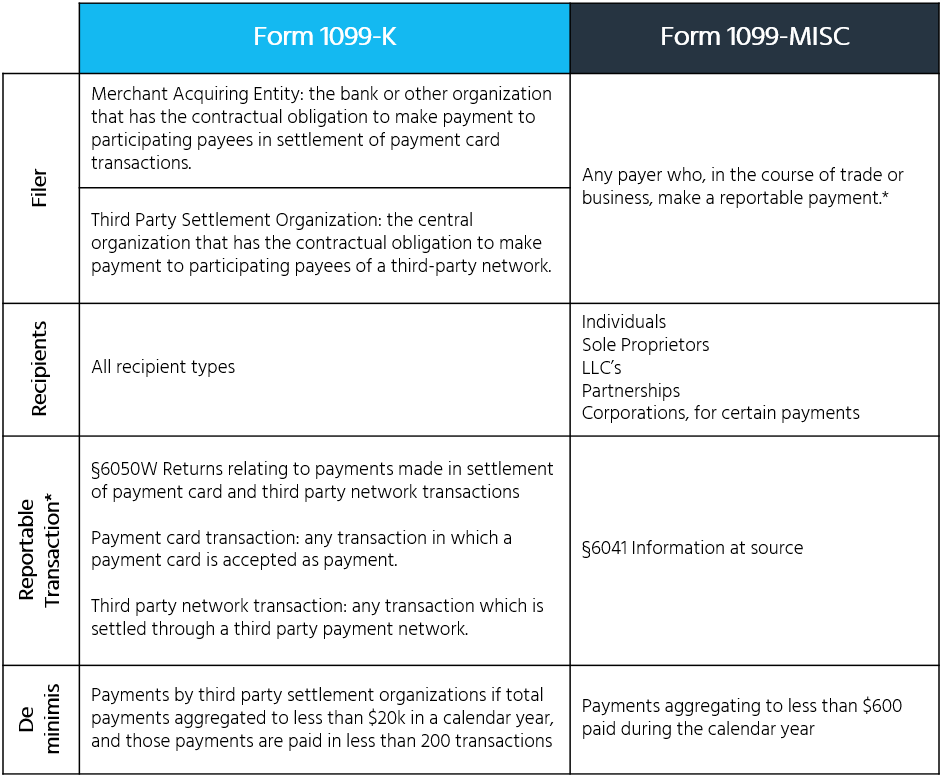

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Everything You Need To Know About 1099 S And How To File Them Yourself Online Countless

Everything You Need To Know About 1099 S And How To File Them Yourself Online Countless

1099 Misc 2019 1099 Misc 2019 2020 1099 Misc Fillable Form 2019 Irs Forms Efile Fillable Forms

1099 Misc 2019 1099 Misc 2019 2020 1099 Misc Fillable Form 2019 Irs Forms Efile Fillable Forms

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

Must You Send 1099 Forms To Contractors Paid Via Paypal Or Credit Card Small Business Trends Small Business Trends Small Business Blog Business Trends

1099 Misc 1099 K Explained Help With Double Reporting Paypal And Coinbase Youtube

1099 Misc 1099 K Explained Help With Double Reporting Paypal And Coinbase Youtube

If I Paid All My Contractors Via Paypal Do I Need To Issue Any 1099s Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Small Business Tax Small Business Accounting

If I Paid All My Contractors Via Paypal Do I Need To Issue Any 1099s Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Small Business Tax Small Business Accounting

Fillabletaxforms Create A Free 1099 Misc Form Irs Email Signature Templates Free Email Signature Templates

Fillabletaxforms Create A Free 1099 Misc Form Irs Email Signature Templates Free Email Signature Templates

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

Am I Supposed To File A 1099 Misc Form The Smart Keep Inc Small Business Tax Tax Organization Tax Quote

All About Forms 1099 Misc And 1099 K Brightwater Accounting

All About Forms 1099 Misc And 1099 K Brightwater Accounting