Nonbusiness Energy Property Tax Credit 2019 Form

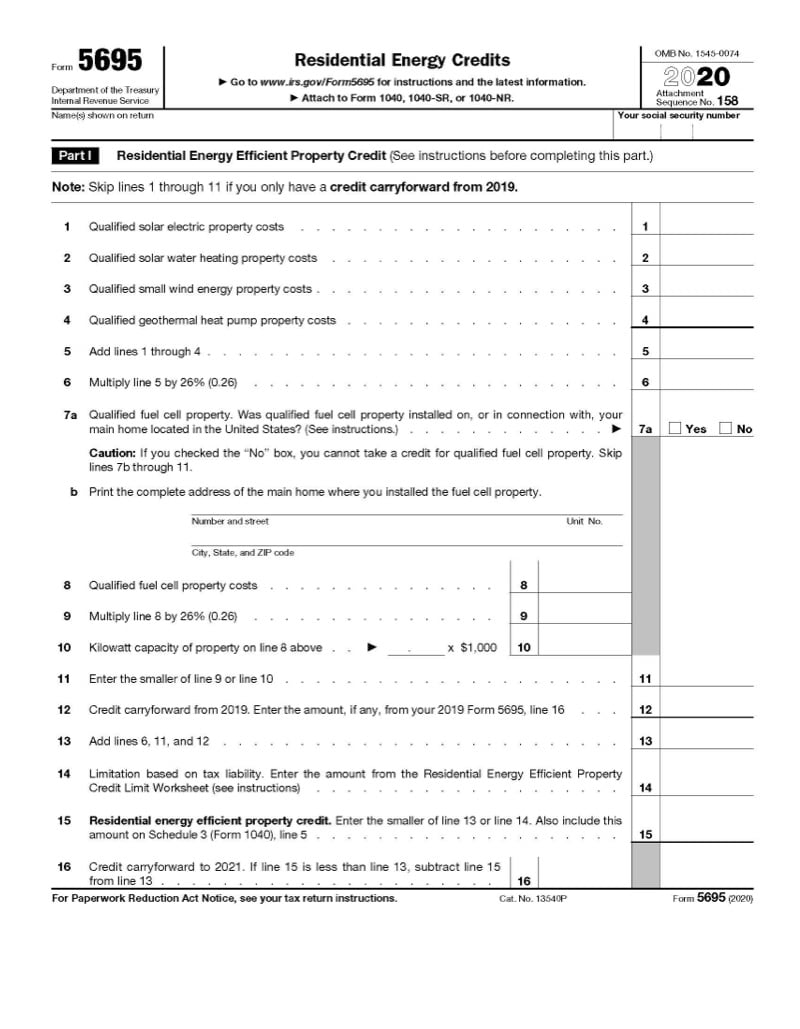

Claim the credits by filing Form 5695 with your tax return. To learn more about the nonbusiness energy credit visit wwwenergystargov.

Form 5695 Claiming Residential Energy Credits

Form 5695 Claiming Residential Energy Credits

Who Can Take the Credits You may be able to take the credits if you made energy saving improvements to your home located in the United States in 2020.

Nonbusiness energy property tax credit 2019 form. Enter the smaller of line 28 or line 29. December 31 2021 Details. Click the Next button.

Before claiming a credit review the instructions to Form 5695 to make certain that the taxpayer and the improvements qualify for the credit. Mar 23 2021 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file. Generally improvements must meet certain energy efficiency requirements.

Attach to Form 1040 1040-SR or 1040-NR. Maximum Lifetime Credit Limit. In 2018 2019 and 2020 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.

The maximum lifetime credit for all types of property combined is 500. Use Form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. Also use Form 5695 to take any residential energy efficient property credit carryforward from 2019 or to carry the unused portion of the credit to 2021.

Also include this amount on Schedule 3 Form 1040 or 1040-SR line 5. The Non-business Energy Property Credit. 30 Form 5695 2019.

And California Revenue and Taxation Code Sections 12206 17058 and 236105 pertaining to the State Tax Credit. If this change is in the form of an increase the increase by law. Scroll down to the bottom of the screen.

Entries for form 5695 are made on screen 5695 on the first Credits tab. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021. The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

Names shown on return. 10 of the amount paid or incurred for qualified energy efficiency improvements installed during 2019 and Any residential energy property costs paid or incurred in 2019. Form 5695 2019 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information.

Nonbusiness Energy Property Credit Part II You may be able to take a credit equal to the sum of. Jun 14 2017 In claiming the credit you were allowed to rely on the Manufacturers certification statements as to whether the purchase qualified as a nonbusiness energy credit. Residential Energy Credits - 5695.

If more than 500 of nonbusiness energy property credits had been claimed by the taxpayer since 2005 the credit could not be claimed. Non-business energy property credit The non-business energy property credit can reduce your tax bill for some of the costs you incur to make energy-efficient improvements to your home. Dec 06 2019 Click on EIC Residential Energy Oth Credits.

IRS instructions state that an amended 2018 tax return can be filed to claim this credit for energy efficient building property however when I enter an amount in the input screen for form 5695 the form does not generate. 30 Nonbusiness energy property credit. PACE Property Assessed Clean Energy is a program authorized in State law through which a property.

Dec 31 2020 You must complete IRS Form 5695 if you qualify to claim the non-business energy property credit or the residential energy-efficient property credit. TREASURER AND TAX COLLECTOR. On the left-side menu select Nonbusiness Energy Property Credit 5695.

Remove any entry in Nonbusiness energy credit Form 5695 Override. The residential energy efficient property credit and The nonbusiness energy property credit. Who Can Take the Credits.

Through the 2020 tax year the federal government offers the Nonbusiness Energy Property Credit. Dec 16 2016 An owner or tenant of a residential property located in the commonwealth who is not a dependent of another taxpayer and who occupies the residential property as his or her principal residence is allowed a solar and wind energy credit energy credit against personal income tax equal to fifteen percent of the net expenditure for renewable energy source property. The nonbusiness energy property credit.

Remove any entry in Residential energy efficient property credit Form 5695 Override. The residential energy credits are. The Taxpayer Certainty and Disaster Tax Relief Act of 2019 has made the nonbusiness energy property credit available for 2018 and 2019.

To access the residential energy credits in TaxSlayer Pro from the Main Menu of the tax return Form 1040 select. 10 of cost up to 500 or a specific amount from 50-300. Equipment Tax Credits for Primary Residences.

Nov 15 2019 I represent I have read Section 42 of the Internal Revenue Code IRC pertaining to Federal Tax Credits and if applying for State Tax Credits I represent I have also read California Health and Safety Code Sections 501994 et seq. Your social security number. Of this total not more.

Must be an existing home. Or Form 1040-NR line 50. Also use Form 5695 to take any residential energy efficient property credit carryforward from 2019 or to carry the unused portion of the credit to 2021.

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Form 5695 Instructions Information On Irs Form 5695

Form 5695 Instructions Information On Irs Form 5695

Form 5695 Instructions Information On Irs Form 5695

Form 5695 Instructions Information On Irs Form 5695

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Steps To Complete Irs Form 5695 Lovetoknow

Steps To Complete Irs Form 5695 Lovetoknow

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Form 5695 For 2020 2021 Energy Tax Credits

Form 5695 For 2020 2021 Energy Tax Credits

Understanding The Energy Tax Credit 2019 Than Merrill

Understanding The Energy Tax Credit 2019 Than Merrill

How To Claim The Federal Solar Investment Tax Credit Solar Sam

How To Claim The Federal Solar Investment Tax Credit Solar Sam

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Federal Tax Credit Of 500 00 For Home Window Films Installed In 2020

Federal Tax Credit Of 500 00 For Home Window Films Installed In 2020

5 Potential Homeowner Tax Credits And Deductions

5 Potential Homeowner Tax Credits And Deductions

Home Energy Residential Tax Credits 2020 2021

Home Energy Residential Tax Credits 2020 2021

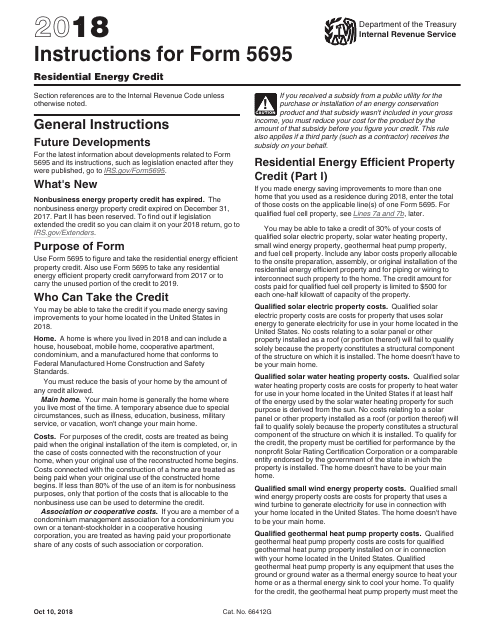

Download Instructions For Irs Form 5695 Residential Energy Credit Pdf 2018 Templateroller

Download Instructions For Irs Form 5695 Residential Energy Credit Pdf 2018 Templateroller

Https Www Irs Gov Pub Irs Prior I5695 2018 Pdf

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions