Should I Get A 1099 For My Hsa

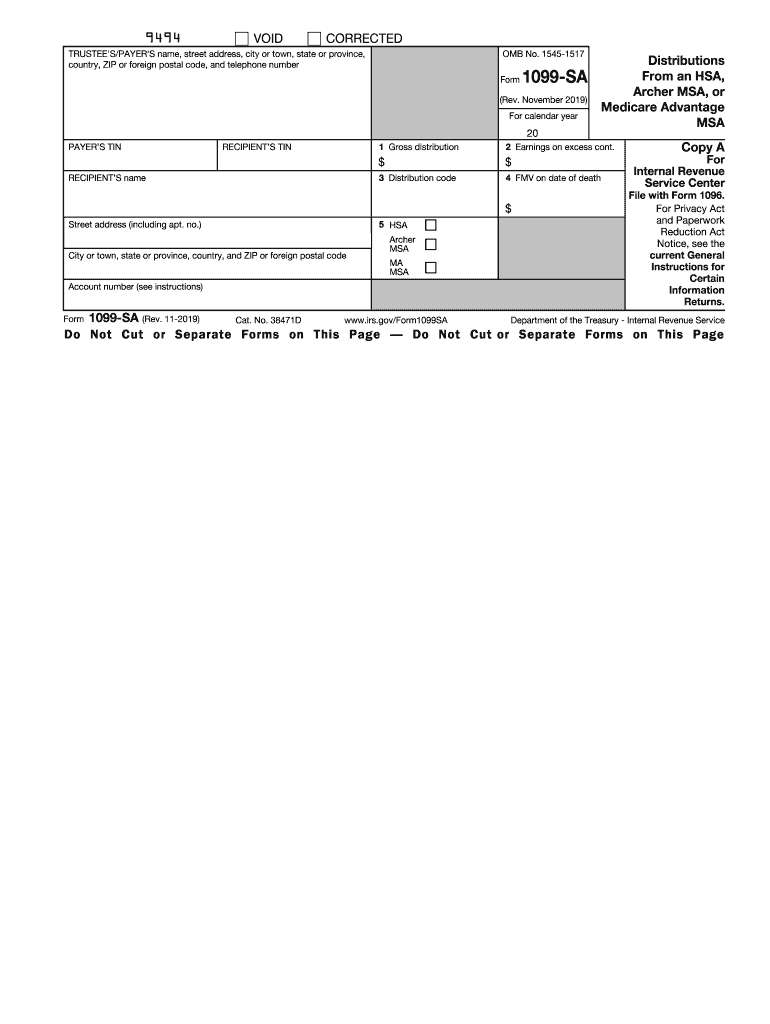

By February 1st you should have also received Form 1099-SA from your HSA custodian stating total distributions money you withdrew from your HSA for the year. Theres a sample 1099-SA form from the IRS here.

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

You must report distributions from your HSA on IRS Form 8889.

Should i get a 1099 for my hsa. When you use the funds from a Health Savings Account HSA or a medical savings account MSA such as an Archer MSA or Medicare MSA the institution that administers the account must report all distributions on Form 1099-SA. Youll get Form 1099-SA not to be confused with Form SSA-1099 if you used funds in your Health Savings Account HSA or a Medical Savings Account MSA to pay for health care expenses. You will receive this form from your HSA provider postmarked no later than January 31 of the year after the tax year for which you are filing for example Jan.

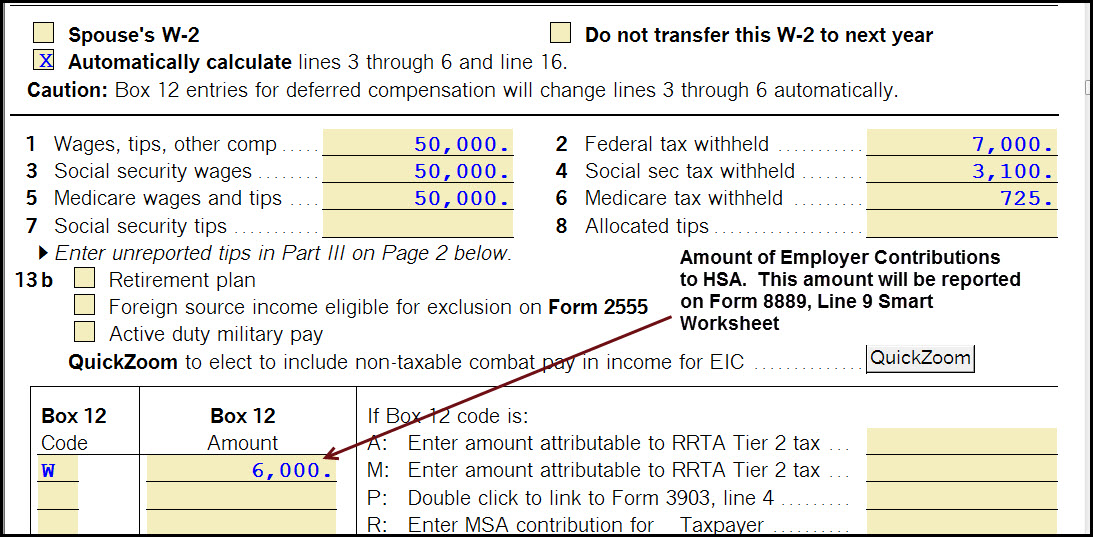

Several tax incentives are available for you to save money on medical care costs. When removing excess contributions from your account you must inform your HSA trustee. Form 5498-SA will detail contributions you made and your W-2 will have any employer HSA contributions.

Form 1099-SA should detail all distributions. If you take a distribution your HSA provider will send you Form 1099-SA. This includes any HSA funds you spent on medical expenses with a payment card and money withdrawn through online reimbursement requests.

Form 1099-SA documents your HSA distributions also called withdrawals for 2020. You could get a Health Savings Account HSA or a medical savings account MSA such. All this information will go on your Form 8889.

Form 1099-SA shows all HSA distributions for the prior year including withdrawals for HSA-qualified and non-qualified medical expenses and removals of excess contributions. Form 1099-SA reports all withdrawals including charges to your HSA debit card you have made from your HSA during the tax-year. Youll only receive this form if you made withdrawals from your HSA in 2020.

You receive a 1099-SA form if you must report distributions from health savings medical savings and Medicare Advantage accounts. Health savings account HSA. Where can I get additional information regarding HSA tax forms and filing information.

31 2021 for 2020 tax year. These IRS tax forms are also available in the Member Website. Your former HSA custodian should provide a Form 1099-SA for any distribution activity that occurred before your account was transferred.

You should be prepared to file Form 8889 with your annual taxes. Once the tax year ends you should start receiving forms from your HSA administrator. File Form 1099-SA Distributions From an HSA Archer MSA or Medicare Advantage MSA to report distributions made from a health savings account HSA Archer medical savings account Archer MSA or Medicare Advantage MSA MA MSA.

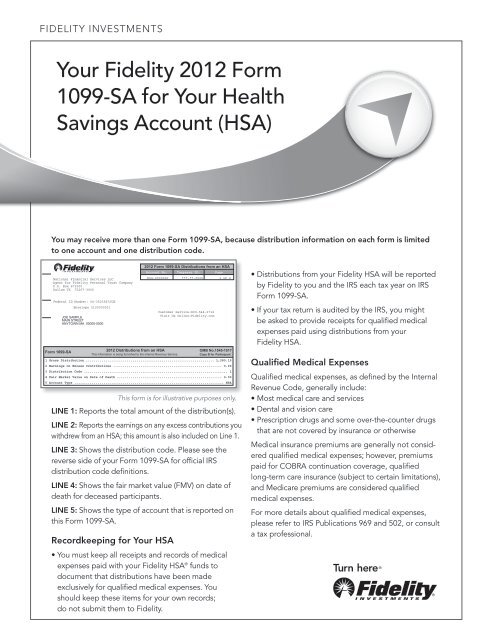

Its important that you enter the information from your 1099-SA before you enter your medical expenses so we can properly calculate your medical expense deduction. IRS Form 1099-SA This form is sent to you at the end of January already filled out by your HSA custodian and should be used to help you complete your IRS Form 8889. Each year HSA providers are required to send a copy of Form 1099-SA by January 31 st to all HSA account holders who made withdrawals also called distributions in the prior year.

When you choose to be reimbursed for an eligible medical expense thats called a distribution. File Form 1099-SA to report distributions made from a. By January 31 you should have also received Form 1099-SA from your HSA custodian stating total distributions money you withdrew from your HSA for the year.

Form 5498-SA summarizes your HSA contributions holdings and fair market value. The excess funds that were withdrawn will be listed on Form 1099-SA as a distribution in Box 1 for the tax year in which the distribution was taken. You should report the withdrawal amounts from Form 1099-SA on Form 8889 only if you withdrew from your HSA.

The distribution may have been paid directly to a medical service provider or to the account holder. Otherwise they wont know to do it. Health Savings Account HSA You will receive the IRS Form 1099-SA and IRS Form 5498-SA either by mail or electronically based upon your elected delivery preference.

IRS Form 1099-SA is provided for each HSA distribution you made in the current tax year. Archer Medical Savings Account Archer MSA. Instructions are on page 3.

This includes any HSA funds you spent on medical expenses with a payment card and money withdrawn through online reimbursement requests. Medicare Advantage Medical Savings Account MA. Form 1099-SA tells you the total distributions or payments that were made from your HSA.

If not you would not receive a 1099-SA so in the HSA interview Federal Taxes-Deductions Credits-Medical click on HSA MSA Contributions just skip adding a 1099-SA. You may receive multiple 1099-SA forms if you made withdrawals from multiple HSAs in 2020 switched HSA. If theres something that doesnt match between forms 1099-SA and 8889 resolve it before filing your taxes.

The 1099-SA is used to report any distribution withdrawal of funds from your HSA during the prior year. For more information regarding tax-filing requirements for your HSA consult your tax advisor. You can repay a mistaken distribution from a health savings.

The HSA Bank 1099-SA form may look slightly different but it will contain the same information. But if you did take distributions you need to contact your HSA plan administrator the bank or financial institution that gave you the debit card to pay for qualified medical expenses with and get a copy of.

Irs Form 1099 R Box 7 Distribution Codes Ascensus

2019 2021 Form Irs 1099 Sa Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Irs 1099 Sa Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Https Mybenefitwallet Com Cms Docs Default Tax Info For Employers Pdf

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Your Fidelity 2012 Form 1099 Sa For Your Health Savings Account

Your Fidelity 2012 Form 1099 Sa For Your Health Savings Account

1099 Sa Hsa Archer Msa Cpy A Cut Sht Item 89 5123

1099 Sa Hsa Archer Msa Cpy A Cut Sht Item 89 5123

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Reporting Distributions On Forms 1099 R And 1099 Sa Ascensus

Tax Statements You Need To File Your 2020 Return Don T Mess With Taxes

How Do I Enter Information For A Health Savings Ac Intuit Accountants Community

How Do I Enter Information For A Health Savings Ac Intuit Accountants Community

Understanding Form 8889 For Hsa Contributions And Tax Deductions

Understanding Form 8889 For Hsa Contributions And Tax Deductions

5498 Ira Esa Sa Contribution Information 1099r

5498 Ira Esa Sa Contribution Information 1099r

What Is Irs Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Turbotax Tax Tips Videos

What Is Irs Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Turbotax Tax Tips Videos

Form 8889 Instructions Information On The Hsa Tax Form

Form 8889 Instructions Information On The Hsa Tax Form

How To Handle Excess Contributions On Form 8889 Hsa Edge

How To Handle Excess Contributions On Form 8889 Hsa Edge

Hsa Tax Filing Tips What Your Employees Need To Know For This Tax Season Willis Towers Watson

Hsa Tax Filing Tips What Your Employees Need To Know For This Tax Season Willis Towers Watson

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition