Is There A Tax Credit For Hiring Convicted Felons

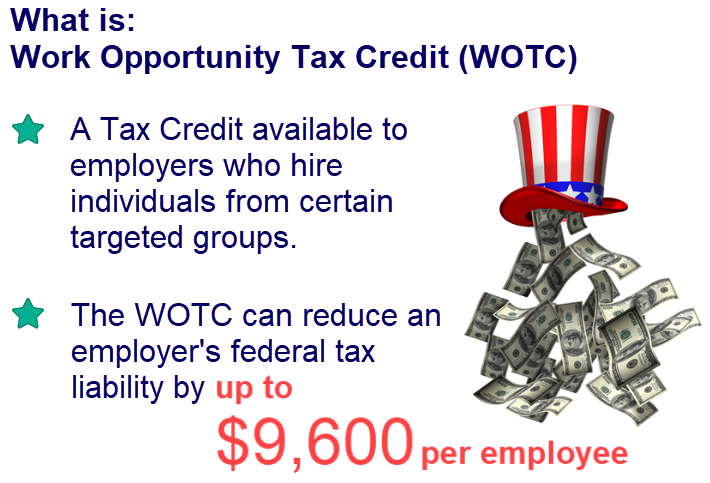

Substantial tax credits are available for hiring ex-felons such as the Federal Work Opportunity Tax Credit. Per the DOL website the Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain target groups who have consistently faced significant barriers to employment One of the target groups is ex-felons.

Jobs For Felons The Facts About Companies That Hire Ex Offenders And Felons 2018 Felon Facts Job

Jobs For Felons The Facts About Companies That Hire Ex Offenders And Felons 2018 Felon Facts Job

In the first year an employer can claim a tax credit of 40 of the employees wages and 25 of their wages the second year for those employees working at least 400 hours.

Is there a tax credit for hiring convicted felons. The Work Opportunity Tax Credit is the Federal tax credit ranging between 2400 9600 that can be availed by firms that hire felons. It applies to previously incarcerated individuals hired no later than one year after conviction or release from prison. Regional Offices The Work Opportunity Tax Credit WOTC is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment.

After hiring an ex-felon youll complete a few forms and submit them to your states workforce agency. The employer or company can enjoy the tax credits if certain requisites are met. This tax credit can apply to you if you hire an individual who was convicted of a felony and who is hired not more than one year after the conviction or release from prison.

There is no limit to the number of felons that one company can hire. In fact most companies would prefer to hire people who will be soon nominated for sainthood which leaves candidates with a criminal record out. Employers may hire as many felons as they want under this program and will receive up to 2400 for a two-year period for each one employed depending on how many hours the employee works.

The Hire Tax Credit while not specifically meant to benefit ex. Hiring a convicted felon isnt what most businesses set out to do. Heres what you.

If the employee works at least 120 hours for you you can claim a. Work Opportunity Tax Credit WOTC The WOTC is a program sponsored by the United States Department of Labor to promote the hiring of people from specific target groups that experience barriers to employment. The Work Opportunity Tax Credit WOTC is a program offered by the Federal Government to give employers tax benefits for hiring ex-felons.

Employers can also claim tax credits for up to 40 of a felons wages in their first year of employment. The Work Opportunity Tax Credit WOTC The government has created the WOTC for companies willing to hire individuals with employment barriers such as ex-felons. Employers may receive WOTC certification between 1200 and 9600 depending on the target group by hiring and retaining from the following.

The second year employers can claim 25 depending on the number of hours clocked. It operates on an individual basis for each applicant and there is no cost to the employer for the first six months. The employer is guaranteed compensation for any loss suffered due to hiring at-risk workers.

Employers need to keep in mind though that many saints have checkered pasts and so may some of your best employees. The Work Opportunity Tax Credit is a provision of the Internal Revenue Code that authorizes a tax credit for companies that hire from certain populations like veterans recipients of. Some states even provide partial wage reimbursement additional tax credits and other training funds for employers who hire ex-felons.

The Work Opportunity Tax Credit WOTC is a federal government program offering a tax credit to incentivize employers to hire ex-felons and applicants from other groups with work entry barriers such as veterans and recipients of temporary assistance TANF and food stamps SNAP. We wrote a whole blog post about WOTC here. In the first year an employer can claim a tax credit of 40 of the employees wages and 25 of their wages the second year for those employees working at least 400 hours.

The Federal Bonding Program is an insurance program wherein the employer is provided free of cost fidelity. The Department of Labor offers tax breaks for companies that hire felons through the Work Opportunity Tax Credit Program. The organization could qualify for a tax credit.

Employers can receive anywhere from 1200 to 9600 per employee. If your business employs an ex-felon you can qualify for the WOTC. Employers may hire as many felons as they want under this program and receive up to 2400 for a two-year period for each one employed depending on how many hours the employee works.

These standards are useful in encouraging the employment of ex-felons who are the most economically disadvantaged. The Kentucky Career Center Tax Credit Unit coordinates the USDOL-ETA WOTC program which provides employers financial incentives when hiring workers from targeted groups of job seekers by reducing an employers federal income tax liability.

Jobs For Ex Offenders And Felons From Jail To A Job Online Jobs Soft Skills Job

Jobs For Ex Offenders And Felons From Jail To A Job Online Jobs Soft Skills Job

Employer Incentives Jails To Jobs

Employer Incentives Jails To Jobs

What Is The Work Opportunity Tax Credit Howstuffworks

What Is The Work Opportunity Tax Credit Howstuffworks

How To Reduce Your Federal Tax Liability By Up To 9600 Employee With Wotc

How To Reduce Your Federal Tax Liability By Up To 9600 Employee With Wotc

National Institute Of Justice Research Report School Security Argumentative Essay Research Report

National Institute Of Justice Research Report School Security Argumentative Essay Research Report

Tax Benefits For Hiring Felons Taxes Irs Jobs Prison Reform Conviction Job Search

Tax Benefits For Hiring Felons Taxes Irs Jobs Prison Reform Conviction Job Search

Hiring Felons Companies Warm To Idea Of Employing Ex Offenders

Hiring Felons Companies Warm To Idea Of Employing Ex Offenders

Changes To The Child Tax Credit In 2019 Child Tax Credit Tax Credits Tax Deductions

Changes To The Child Tax Credit In 2019 Child Tax Credit Tax Credits Tax Deductions

/GettyImages-9471446221-5b61bf1746e0fb002c1b89cb.jpg) How Does The Work Opportunity Tax Credit Work

How Does The Work Opportunity Tax Credit Work

Wotc 101 Arizona Department Of Economic Security

Wotc 101 Arizona Department Of Economic Security

The Work Opportunity Tax Credit A Win Win For Business Owners And Disabled Workers Tax Pro Center Intuit

The Work Opportunity Tax Credit A Win Win For Business Owners And Disabled Workers Tax Pro Center Intuit

Ex Offenders And Felons Have A Tough Time Getting Jobs Getting Hired With A Criminal Record May Be Hard But It Is Not Impossible Job Hunting Job Social Work

Ex Offenders And Felons Have A Tough Time Getting Jobs Getting Hired With A Criminal Record May Be Hard But It Is Not Impossible Job Hunting Job Social Work

The Friendly Felon Life After A Felony Finding Second Chances After Conviction Felon Second Chances Infographic

The Friendly Felon Life After A Felony Finding Second Chances After Conviction Felon Second Chances Infographic

Myth Buster Work Opportunity Tax Credit Nc Second Chance Alliance

Myth Buster Work Opportunity Tax Credit Nc Second Chance Alliance

Https Www Masslegalservices Org System Files Library Advantages 20of 20hiring 20people 20with 20cori Pdf

Felon Can T Get Around Background Check The Fact Is Ex Offenders And Felons Get Jobs Everyday Your Challenge Is To F Felon Background Check How To Find Out

Felon Can T Get Around Background Check The Fact Is Ex Offenders And Felons Get Jobs Everyday Your Challenge Is To F Felon Background Check How To Find Out

Hiring Ex Felons Does Felon Friendly Pay Cost Management Services Work Opportunity Tax Credits Experts

Worker Opportunity Tax Credit A 4 9 Billion Value Right On Crimeright On Crime

Why Hiring Felons Could Lead To Great Employees Big Benefits Info Cubic

Why Hiring Felons Could Lead To Great Employees Big Benefits Info Cubic