How To Get 1099 From Lyft 2020

You should receive a 1099-K if you had 200 transactions for Uber and Lyft. RSG contributor Jay shows you how to take care of your rideshare taxes in 6 essential steps - and he provides a walk-through.

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2021

Here is the link youll need to request a 1099 from Postmates.

How to get 1099 from lyft 2020. Many of you if you did not earn enough will not actually receive a 1099 from Uber or Lyft so youll have to enter that income manually based on the tax summary that each sent to you at the end of 2019beginning of 2020. For ride receipts from passengers in the past year. Youll get a 1099-K as long as you earned at least 600 in ride payments.

Uber and Lyft send out 1099 forms every year by January 31. If you made more than 599 through those payments Lyft should send you a Form 1009-K that summarizes those earnings. Taxes as an independent contractor might seem scary but theyre.

As a freelancer it is typical to get Form 1099-MISC in the mail in January from your clients or employer. Debit cards credit cards and shared-value cards like gift cards. Congratulations on your own rideshare business.

Instead youll receive that information on your Driver Dashboard or on one or more Forms 1099 that will be mailed to you depending on how much you earned. You may not have the incometransactions that call for a 1099-K or the miscellaneous payments that call for a 1099-NEC. If you live there and made more than 600 last year as an independent contractor youll receive a 1099.

This form which reports your income for the previous tax year. Whether you drive for Lyft full-time or part-time youre now enjoying the pay perks and prerogatives of being self-employedfrom setting your own hours to building customer relations. The increasing number of independent contractors in the United States as well as some deadline confusion has led the IRS to resurrect the 1099-NEC form.

Even if you dont receive the 1099-K you. A central place for you to find your 2020 tax information learn how to maximize your savings and access other useful information. Postmates Tax Form 1099.

One of the things a lot of new drivers overlook when theyre just getting started is taxes. The only one who can give you your 1099 is the company you work for. How to pay your taxes and do yo.

If you are a rideshare driver for Uber or Lyft you are technically self-employed which means instead of pay stubs Uber and Lyft will provide you with a 1099 every year in January. With the onset of tax season you face a new business challenge. Customers must use a card to pay on each ride that you provide.

While Stride operates separately from Postmates I can tell you that Postmates will only prepare a 1099. Here are the requirements to get a 1099 for the 2020 tax year. Vermont and Massachusetts are an exception to this rule.

Uber and Lyft are required to send you one or both of these documents if you earn within certain thresholds. If you drove full time earned more than 20000 and had more than 200 transactions in 2020 youll usually get a 1099-K form. Filing your taxes in a way that minimizes your tax liability.

Then you enter the income on your tax return. Lyft will send 1099-MISC forms to drivers who earned at least 600 through non-driving activities like referrals and other bonuses in 2018. Yes the Lyft 1099 form 2018 is different from the forms drivers will receive in 2020.

If you dont get a 1099 then you likely didnt earn enough income. Weve put together a list of the 6 fastest ways to get in touch with Uber here and the six best ways to contact Lyft. One may also ask can you get pay stubs from LYFT.

IRS Free File. To access your 1099-MISC form you need to accept an invite DoorDash sends you. Follow these tips on how to use your Lyft 1099 to complete your tax return and.

Form 1099-K which tracks self-employment income made via a payment card. Unfortunately Uber and Lyft do not provide pay stubs which can make some situations rather difficult. IRS Form 1099-K summarizes the income you earned through payment card and third-party transactions.

Click to see full answer. If youre eligible for a 1099-K or 1099-MISC form they can be downloaded from the Tax Information tab of your Driver Dashboard. When you do you automatically get a Payable account so you dont have to create one on your own.

Vermont Massachusetts and Virginia. However there are instances where you may not receive one and you may be questioning What If I Didnt Get a 1099. Now it is time to settle up with the IRS.

Depending on your Lyft Rewards tier you may be eligible for additional savings. Form 1099-MISC summarizes your non-driver compensation. At least 200 rides and at least 20000 in ride payments from passengers in the year.

Youll get this IRS tax document if you made more than 20000 and provided at least 200 rides andor deliveries. As a self-employed individual running your own business you will not receive a W-2 from Lyft that details your ridesharing earnings for the year. Now those who earn wages as non-employment compensation will receive a 1099-NEC rather than a 1099-MISC.

If you have not received your 1099 form from Uber or Lyft you may need to reach out to Uber and Lyft to get those forms. The unofficial document from Uber and Lyft which provides a breakdown of your annual earnings and all of your business-related expenses that may be deductible including your online miles driven. Some rideshare drivers will receive official tax forms 1099-K1099-NEC from companies such as Lyft but not in some cases.

5 Form Amazon What I Wish Everyone Knew About 5 Form Amazon Everyone Knows This Or That Questions Tax Software

5 Form Amazon What I Wish Everyone Knew About 5 Form Amazon Everyone Knows This Or That Questions Tax Software

Image Result For Uber Sign Printable Lyft Driver Uber Driving Lyft

Image Result For Uber Sign Printable Lyft Driver Uber Driving Lyft

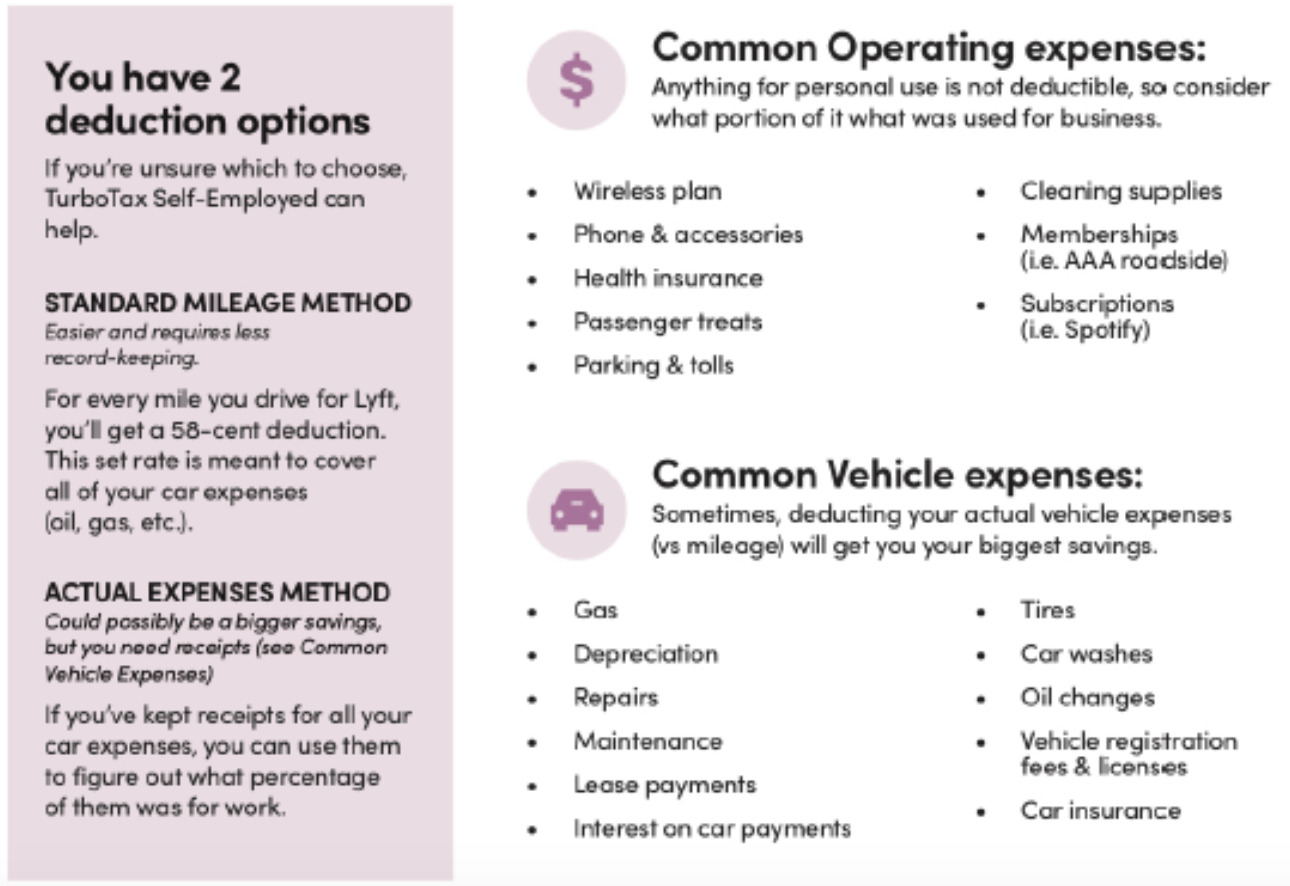

Filing Taxes Tax Tax Deductions

Filing Taxes Tax Tax Deductions

How To Get Your Employment Or Income Verification At Lyft

How To Get Your Employment Or Income Verification At Lyft

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Uber And Lyft Statistics Infographic Ecommerce Infographic Infographic Lyft

Uber And Lyft Statistics Infographic Ecommerce Infographic Infographic Lyft

Massachusetts Joins Fight In Classifying Drivers As Employees Rideshare Driver Rideshare Lyft Driver

Massachusetts Joins Fight In Classifying Drivers As Employees Rideshare Driver Rideshare Lyft Driver

Drive For Uber Lyft Or Sidecar Follow These Tax Rules In 2020 Uber Driving Lyft Car Lyft Driver

Drive For Uber Lyft Or Sidecar Follow These Tax Rules In 2020 Uber Driving Lyft Car Lyft Driver

Uber Tax Filing Information Alvia Rideshare Driver Filing Taxes Rideshare

Uber Tax Filing Information Alvia Rideshare Driver Filing Taxes Rideshare

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Free Spreadsheet For Lyft Drivers Lyft Driver Lyft Spreadsheet

Free Spreadsheet For Lyft Drivers Lyft Driver Lyft Spreadsheet

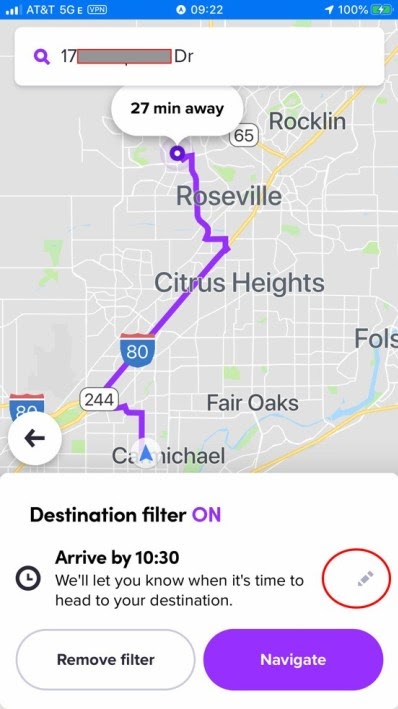

The Ultimate Guide To Understanding Lyft S Destination Mode

The Ultimate Guide To Understanding Lyft S Destination Mode

Uber Tax Filing Information Alvia Uber Filing Taxes Uber Driving

Uber Tax Filing Information Alvia Uber Filing Taxes Uber Driving

Uber Lyft Sign Rideshare Car Windshield Side Windows Display Rideshare Rideshare Driver Uber Driver

Uber Lyft Sign Rideshare Car Windshield Side Windows Display Rideshare Rideshare Driver Uber Driver

2020 Uber Driver Tax Deductions See Uber Taxes Hurdlr Tax Deductions Uber Driver Tax Prep

2020 Uber Driver Tax Deductions See Uber Taxes Hurdlr Tax Deductions Uber Driver Tax Prep

Free Spreadsheet For Lyft Drivers Lyft Driver Rideshare Free Spreadsheets

Free Spreadsheet For Lyft Drivers Lyft Driver Rideshare Free Spreadsheets

How To File Your Uber 1099 Tax Help For Uber Drivers Tax Help Lyft Driver Uber Driver

How To File Your Uber 1099 Tax Help For Uber Drivers Tax Help Lyft Driver Uber Driver