How Do I Get My 1099 Form From Facebook Marketplace

If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. You must have your 1095-A before you file.

1099 Form No Download Needed Pdf Fill Out And Sign Printable Pdf Template Signnow

1099 Form No Download Needed Pdf Fill Out And Sign Printable Pdf Template Signnow

Whether you are preparing to do your own taxes or working with tax professionals it is essential that you document all your income streams carefully.

How do i get my 1099 form from facebook marketplace. Usually marketplaces like Amazon Ebay Mercari and others issue a 1099-k to report your income and only do so when you have hit the threshold of 200 transactions and more than 20000 payments. If you get both forms the health coverage shown on your federal 1095-B may be different from the coverage shown on the state 1099-HC. Look for Form 1095-A.

Step 1 Enter the marketplace When you log in to Facebook you should notice a new shop icon. If you do not receive your 1095-A by then visit the Marketplaces website healthcaregov for information on how to request a copy of your form online from the Marketplace. If this is your first time seeing it Facebook will alert you to this.

Youll receive this form if health insurance advance payments were made on behalf of you or your qualifying family members. Ive seen conflicting information and Im wondering if anyone has experience with this. Anyway I got a notification at one point asking for my SSN because Id sold over 600 and that theyd be sending me tax documents covering my 2020 sales.

Unless you are selling as a business such as Ebay etc to make income. From what I can see itll be a 1099 K. Find out how to read Form 1099-H.

If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February. If youre eligible to receive Form 1099-K youll be issued one by January 31st of each year following the previous tax year. Store this form with your important tax information.

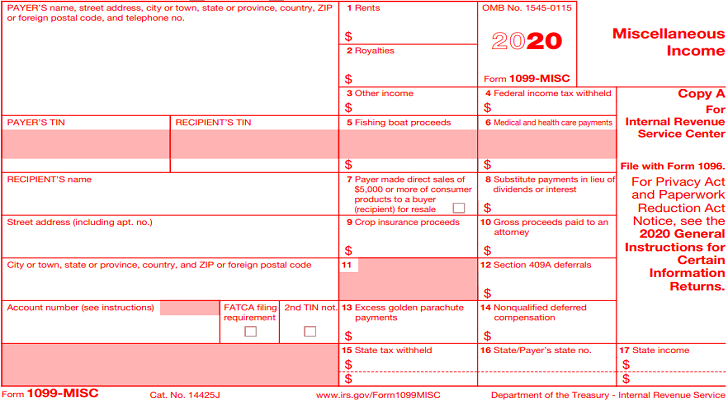

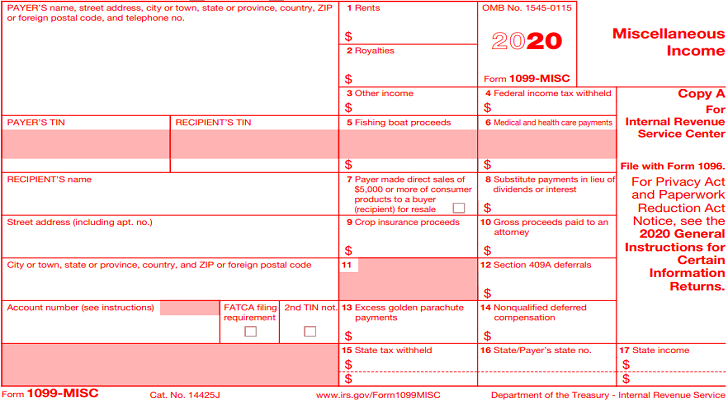

Learn how to receive payments for something you sold with shipping and checkout on Marketplace. It may be available in your HealthCaregov account as soon as mid-January. The IRS requires Facebook to provide a Form 1099-MISC to sellers who receive payments directly from Facebook for participating in one or more Facebook Marketplace incentive programs.

Dont file your taxes until you have an accurate. A Form 1099-K shows the gross amount of all reportable payment transactions completed on Facebook. In actuality it is a report of all revenues added to the account holders balance.

If you do not receive a 1099-HC form you do not need it to fill out your state income tax return. It comes from the Marketplace not the IRS. Click the icon to proceed.

Although the IRS has a reputation for trying to get a piece of just about every cent we bring in when it comes to the occasional garage or yard sa. Facebook marketplace is a garage sale for some and working revenue for others. You should receive Form 1095-A from the Marketplace by the end of January of the tax year.

Youll receive Form 1099-H if you get help paying your health insurance premiums as a TAA ATAA RTAA or PBGC recipient. Does facebook marketplace issue sellers a 1099-k or a 1099-misc. When You Should Receive Form 1095-A.

Generally the answer is NO. If you did not violate the buy and sell feature policies so the Marketplace app icon will start appearing on your mobile app again. This form is issued if you made 200 or more transactions and you received payments of 20000 or more for goods or services via third-party services such as credit card processors or merchant.

You can reconcile the transactions included in the dollar amount on your Form 1099-MISC with your reconciliation report in Commerce Manager. Go to the appeal form and fill in the required fields your name and the detailed issue. For more information about the Form 1099-HC visit health care reform for individuals.

Under the IRS section 6050W this form must be provided to you when your transactions reach the reporting threshold. Ive been selling lots of my old clothingaccessories on Facebook Marketplace taking advantage of some of the promos where they cover shipping costs. Common misconception is that the 1099-K is a report of income.

If you received a Form 1099-K even though your transaction volume for an account is less than the IRS reporting threshold remember that IRS reporting thresholds apply across all accounts if they share a Federal TIN even if the account supports transactions on different platforms. Step by step guide on how to get the Facebook Marketplace icon again Screenshot. Had 2017 Marketplace coverage.

Income Form is a form the IRS requires Molina to file reporting all medical and healthcare non-employee compensation and legal payments made to an individual or company dated during the previous tax year for a combined total of 60000 dollars or more. Even though the Marketplace Facilitator Sales Taxes end up as a break-even equal debits and credits if it got added to your account at any point it will be included in the amounts on the 1099-K. The IRS form 1099-MISC Misc.

Understanding the difference and how it.

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

Understanding Your Tax Forms 2016 1099 B Proceeds From Broker Barter Exchange Transactions

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

What Is Irs Form 1099 Misc Smartasset

What Is Irs Form 1099 Misc Smartasset

Performing 1099 Year End Reporting

Performing 1099 Year End Reporting

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

The Ultimate Breakdown Of Form 1099 Misc Liberty Tax Service

The Ultimate Breakdown Of Form 1099 Misc Liberty Tax Service

Twitch Streaming Taxes Twitch Insider

Twitch Streaming Taxes Twitch Insider

1099 Misc 2020 Sample Form Crestwood Associates

1099 Misc 2020 Sample Form Crestwood Associates

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png) Form 1099 K Payment Card And Third Party Network Transactions Definition

Form 1099 K Payment Card And Third Party Network Transactions Definition

Schwab Moneywise Calculators Tools Understanding Form 1099

Schwab Moneywise Calculators Tools Understanding Form 1099

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition