Do You Have To Pay Taxes On Small Business Grant Money

Depending on the structure your business itself may need to file a separate tax return and pay its own. In contrast you have to pay back a loan.

Small Business Resiliency Fund Coronavirus

Small Business Resiliency Fund Coronavirus

The aim of this loan is to provide businesses with the money to keep running and continue paying employees not to create a tax burden for businesses receiving the funds.

Do you have to pay taxes on small business grant money. Loans that have to be paid back are never taxable income to the borrower nor are repayments deductible. That means you dont pay taxes on the money that you receive. Under IRS rules if youre a candidate for a degree grants and scholarships for tuition fees books supplies and equipment are not considered taxable income.

That means you can claim a maximum of 5000 per quarter per employee. Sole proprietorship partnerships and a Limited Liability Company LLC do not pay business taxes and pay taxes at the personal tax rate of the owner. The form will ask for the bank account to which you want the grant money direct deposited.

The Employee Retention Credit and Payroll Tax Postponement also offered small businesses relief from the financial impacts of the coronavirus crisis but not in the form of loans or grants. And the best part. You must have been in business as of January 31 2020.

A Quick Simplified Example. Two taxable grants will be paid at the start and end of the six-month period. Maximum wages per quarter per employee are capped at 10000.

A grant is money you dont have to pay back. Get information from the Federal Trade Commission FTC to help you learn to recognize and avoid grant scams. Grants do not require repayment of any kind.

The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50 of the qualified wages an eligible employer pays to employees after March 12 2020 and before January 1 2021. However nonresident aliens based on the Internal Revenue Code Section 117 must report those through Forms 1042 and 1042-S. If you have received PPP funds you are allowed to use the money for both the salaries of your employees and the employee taxes that you would normally withhold and send to the IRS.

It is shown to the satisfaction of the Service that. You do not need to wait to claim this credit when you file your 2020 taxes. Since non-corporate small businesses are taxed through their owners personal tax returns how much they pay in taxes can get mixed up with the tax owed by the.

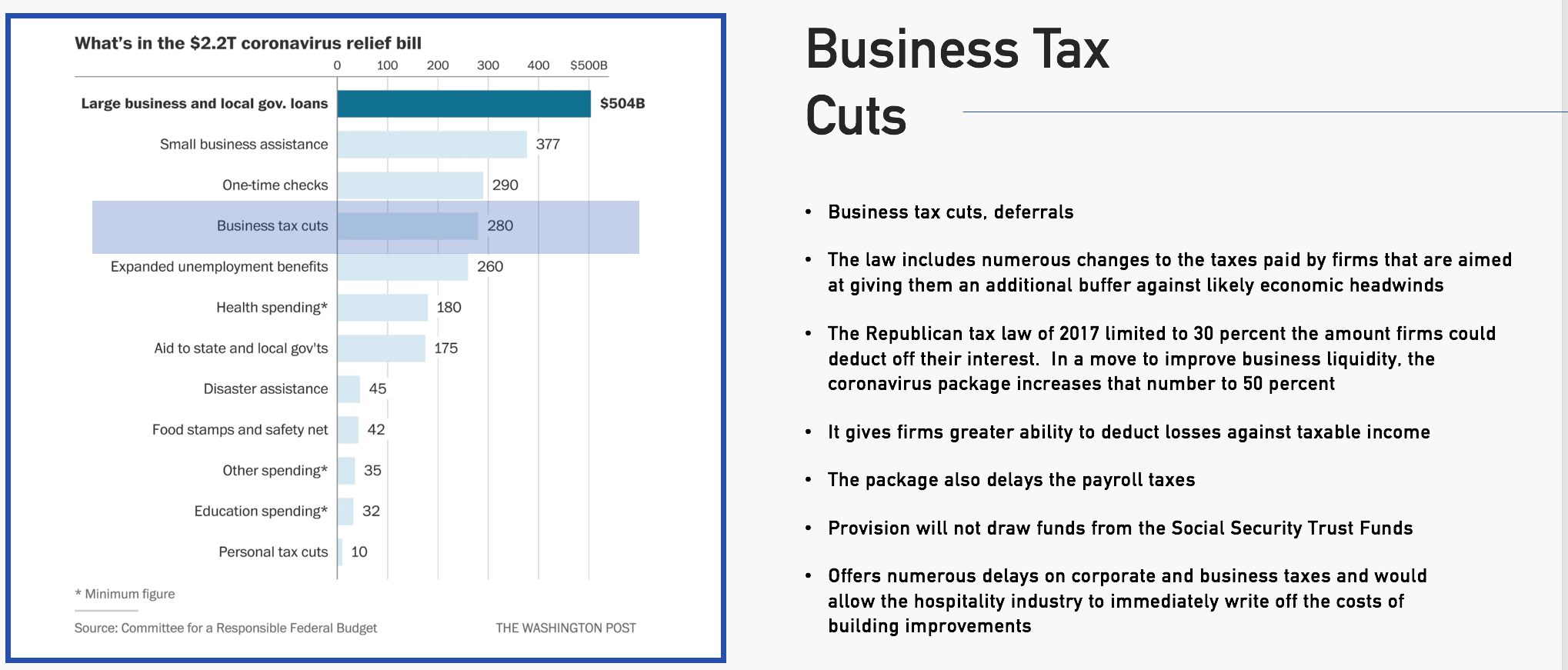

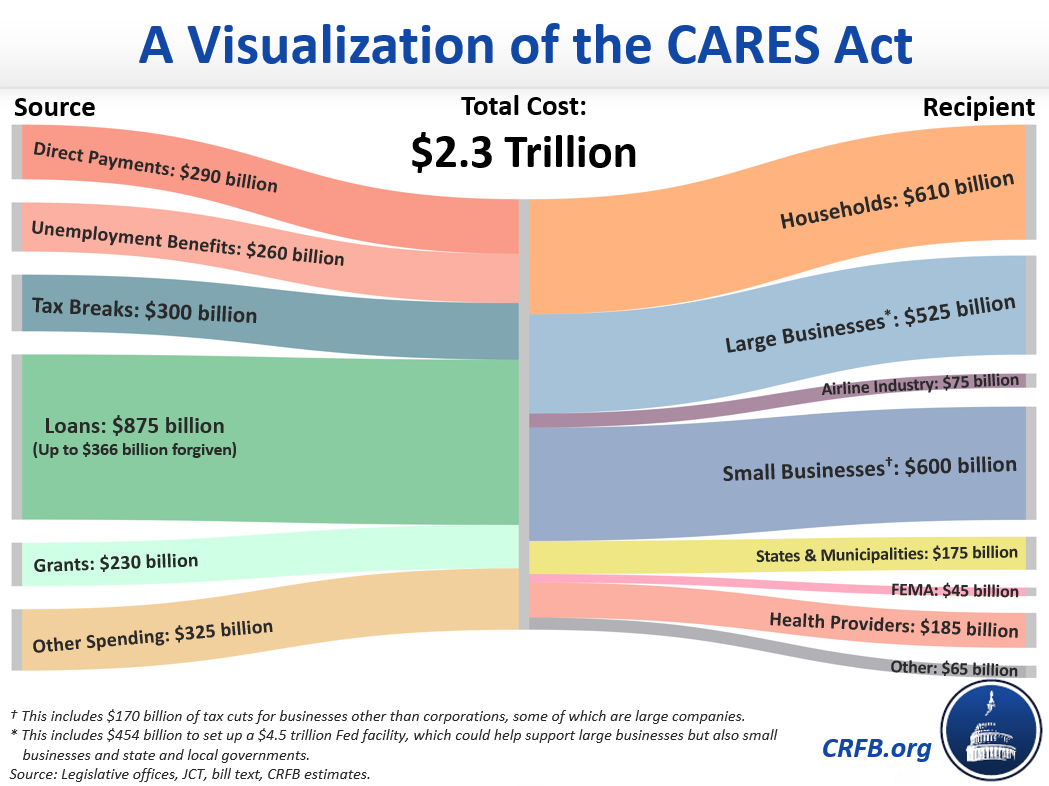

The CARES Act spells out that the forgiven loan amount wont be included in taxable income. Common Taxes for Small Business Owners Income tax Youll owe income tax on your earnings from running the business both on your salary and on any profits. Tribal small businesses.

If you are eligible you can receive a credit of up to 50 of eligible wages paid per quarter to each employee. For example a Small Business Administration SBA Economic Injury Disaster Loan EIDL has to be paid back. But grant money used for items beyond those such as room and board for example are taxable.

The level of the second grant has yet to be announced by the government at the time of writing. In order to give business owners some time and flexibility 50 of the deferred taxes that accumulated in 2020 must be paid by December 31 2021 and 50 of the. If you have been a victim of a grant scam you can file a complaint with the FTC.

Employee Retention Credit Available for Many Businesses Financially Impacted by COVID-19. A grant is money that is given to a person business or corporation from federal state county or local governments or private businesses or corporations. There are a number of companies nonprofits and government agencies providing essentially free money to small business owners in the form of a small business grant.

The first grant will cover 40 of trading profits capped at 3750 and will be paid in a single instalment. Most small businesses are owned by individuals and are not corporations. Do I Have to Pay.

If you receive information stating you qualify for a free grant its probably a scam. Business grants are exempted from tax under allowable conditions since business owners contribute to the improvement of the countrys economy. Employee Retention Credit ERC The ERC was designed to help keep employees on the job by allowing business owners to claim a payroll tax credit.

Grants to individuals for travel study or other similar purposes including loans made for charitable purposes and program-related investments are taxable expenditures unless the following conditions are met. You cant however use these funds to cover the business portion of the taxes that go toward things like FICA and Medicare. You can get immediate access to the credit by reducing the employment tax deposits you are.

The grant is awarded on an objective and nondiscriminatory basis under a procedure approved in advance by the Service and.

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Paycheck Protection Program How It Works Funding Circle

Paycheck Protection Program How It Works Funding Circle

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Paycheck Protection Program How It Works Funding Circle

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Coronavirus Small Business Relief How To Get Grants And Loans Smartasset

Microloan Program The U S Small Business Administration Sba Gov

Microloan Program The U S Small Business Administration Sba Gov

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Covid 19 Small Business Guidance Loan Resources Representative Tim Burchett

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Coronavirus Response Page At Laedc Los Angeles County Economic Development Corporation

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Small Business Grants Covid 19 Relief Where To Find Free Money In 2021 Nav

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 8 2020 2 Pm Pdf

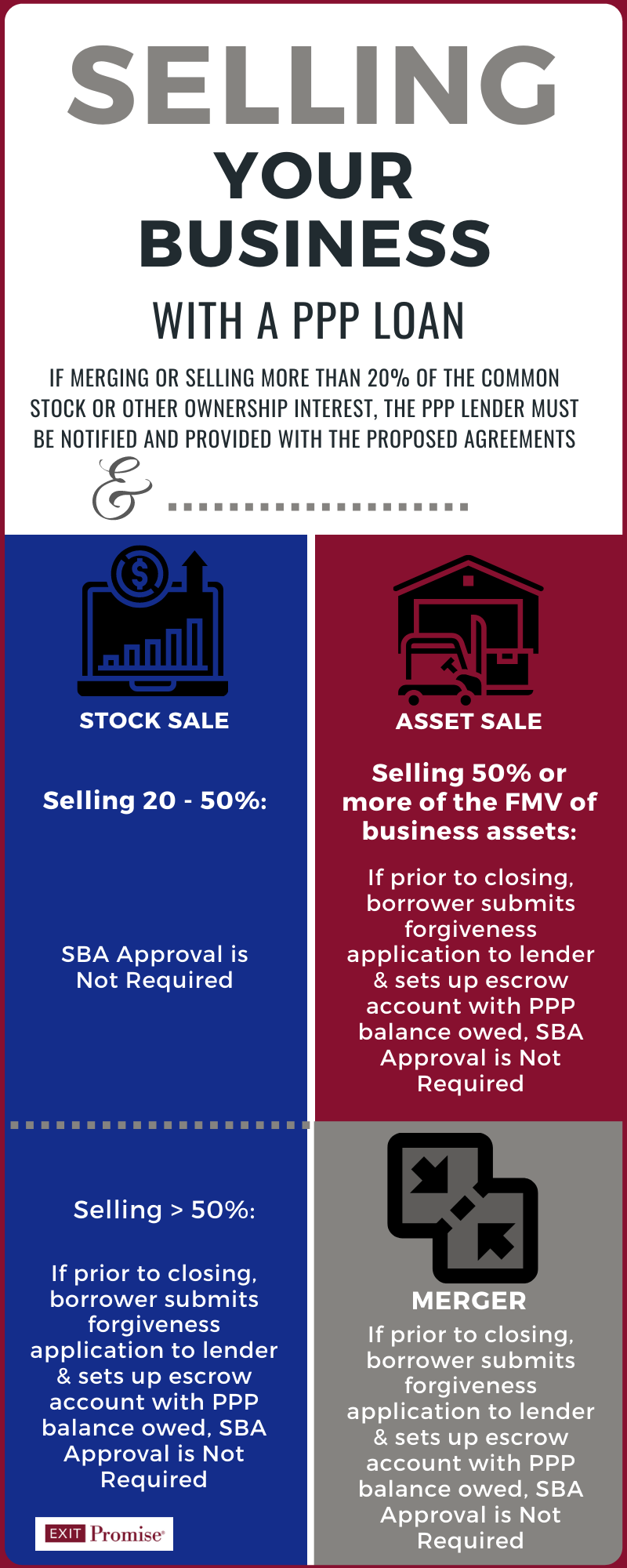

Ppp Loan When Selling A Business Exit Promise

Ppp Loan When Selling A Business Exit Promise

Federal Government Grants For Startup Businesses

Federal Government Grants For Startup Businesses

4 Types Of Entrepreneurship Tips For Women In Business

4 Types Of Entrepreneurship Tips For Women In Business

Small Businesses Don T Overlook These Tax Write Offs Small Business Tax Business Tax Tax Write Offs

Small Businesses Don T Overlook These Tax Write Offs Small Business Tax Business Tax Tax Write Offs

10 Funding Options To Raise Startup Capital For Business

10 Funding Options To Raise Startup Capital For Business