What Expenses Can I Claim As A Self Employed Courier

The cost of repairs servicing and running the vehicle. For example Newspaper delivery drivers have a set route but because they are self-employed their mileage is deductible from the time they leave home and start driving for business.

25 Tax Deductions You Can Claim As A Freelancers Due

25 Tax Deductions You Can Claim As A Freelancers Due

Self-employed individuals can deduct their non-commuting business mileage.

What expenses can i claim as a self employed courier. Allowable Expenses for Couriers. Read more to see what medical and dental expenses can be included in 2020. Self Employed Health Insurance Deduction.

Feb 09 2021 There are all sorts of conflicting ideas out there about what expenses you can claim as a Dasher or delivery driver on your taxes. Petrol or diesel costs. Your license and any other registration fees.

Interest on any loans taken out to pay for. Feb 16 2017 Whether youre a courier for Postmates Amazon Flex DoorDash or any other delivery service youve got business expenses that you can deduct from your delivery income. Train bus air and taxi fares.

Here are a few that Stride wants all delivery drivers to know about. If you spend half the time driving a vehicle to deliver goods and the other half for your own reasons you can claim 50 of the travel costs for your business. Vehicle repair and servicing costs.

The IRS defines self-employment as carrying on a trade or business as a sole proprietor independent contractor single-member LLC or as a member of a partnership. The cost of washing or cleaning your own vehicle. However if you use your phone for both work and personal needs youll need to split your deduction between business and personal use.

Use these resources to learn more about what deductions you can claim if youre a courier. Couriers may be able to claim. Interest on any bank or personal loans taken out to purchase your vehicle.

Choose an accounting method. You can claim allowable business expenses for. Jan 05 2021 If youre self-employed then you can claim these tax deductions.

Jul 02 2020 Yes you would be able to claim back the vehicle hire as a business expense - and the fuel. Jan 07 2021 One of the perks of being a Hermes self-employed courier is that youre able to claim back some of your tax on business expenses. We researched answers to 20 frequently asked questions about deductible business expenses to help you better understand what you can claim on your Doordash taxes.

Here are some common examples of tax allowable expenses for self-employed Deliveroo Riders. A proportion of heating electricity water mortgage interest cleaning insurance and council tax can all be claimed either by using HMRCs expenses checker online or working out the cost based on the floor area or number of rooms used and the proportion of time the space is used for working. For some expenses like business entertainment eg client meals and staff functions you can only claim half.

Register now and start using our tax service for free. Many delivery drivers purchase hot bags and blankets for keeping food deliveries warm courier backpacks phone chargers and dashboard mounting systems and other supplies. As a self-employed individual there are certain essential business costs which arent taxable by HMRC.

Make sure that the mileage they pay you will cover the cost of fuel - if its an Amazon type job where youre often only driving a few hundred metres between drops the fuel economy is going to be appalling compared to a handful of deliveries per day with dozens of miles of driving. For example if you calculate that you use your vehicle 20 of the time for personal or family use then you would need to reduce any relevant vehicle running expenses by 20. The cost of running your office if you have one or use of your home.

Temporary work location relates to a W-2 employee and their expenses would be reported on form 2106. Any expenses that you have incurred which are wholly and exclusively for your work are tax deductible. Most things you pay for working as a Deliveroo Rider will be allowable or tax deductible.

Jun 04 2019 Correct it is all business miles. There are rules set out by HMRC which expenses you can claim for allowable expenses and those you cant disallowable expenses. The costs of your annual road tax and your MOT test.

Free Small Business Expenses Checklist Small Business Expenses Blog Printables Minimalism Blog

Free Small Business Expenses Checklist Small Business Expenses Blog Printables Minimalism Blog

Self Employed Mileage Allowance Explained Goselfemployed Co Mileage Self Finance Blog

Self Employed Mileage Allowance Explained Goselfemployed Co Mileage Self Finance Blog

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

Filing Tax Returns For Delivery Drivers Tips And Advice Turbotax Tax Tips Videos

Filing Tax Returns For Delivery Drivers Tips And Advice Turbotax Tax Tips Videos

Home Office Deduction Worksheet Excel

Home Office Deduction Worksheet Excel

.svg)

Trucker Tax Deductions You Won T Want To Miss Out On

Trucker Tax Deductions You Won T Want To Miss Out On

Tax Deductions For The Self Employed Smartasset

Tax Deductions For The Self Employed Smartasset

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

7 Ways Your Taxes Will Change In 2020 Types Of Taxes Federal Income Tax Tax Deductions

7 Ways Your Taxes Will Change In 2020 Types Of Taxes Federal Income Tax Tax Deductions

Tax Tips For The Self Employed Massage Therapist Discoverypoint School Of Massage Seattle Wa

Tax Tips For The Self Employed Massage Therapist Discoverypoint School Of Massage Seattle Wa

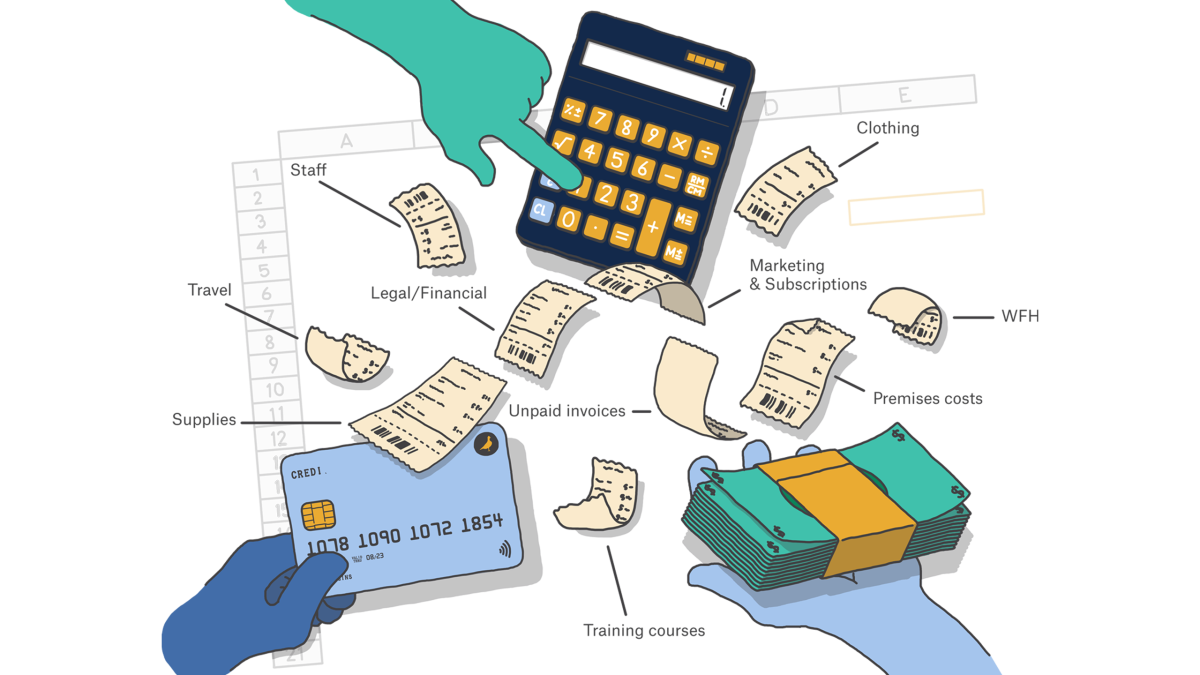

How To Claim Expenses When You Re Self Employed Courier

How To Claim Expenses When You Re Self Employed Courier

Withdrawing From An Hsa Many Know From Experience That Medical Expenses Can Easily Overwhel Life Insurance Policy Life Insurance Cost Life Insurance Premium

Withdrawing From An Hsa Many Know From Experience That Medical Expenses Can Easily Overwhel Life Insurance Policy Life Insurance Cost Life Insurance Premium

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Taxes For Turkers Reporting Self Employment Income Self Employment Income Self

Taxes For Turkers Reporting Self Employment Income Self Employment Income Self

What Can Independent Contractors Deduct

What Are Disallowable Expenses Goselfemployed Co Business Tax Deductions Small Business Tax Deductions Tax Deductions

What Are Disallowable Expenses Goselfemployed Co Business Tax Deductions Small Business Tax Deductions Tax Deductions

Tax Deductions For Self Employed Not On Schedule C Entrecourier

Tax Deductions For Self Employed Not On Schedule C Entrecourier

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Small Business Bookkeeping Business Tax Deductions

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Small Business Bookkeeping Business Tax Deductions