Vermont Small Business Registration

1540 Vermont Route 66 Randolph Vermont 05060 Tel. The first step is selecting your business type.

1947 Simonsville Vermont Motor Vehicle Department Registration Temp License Ebay

1947 Simonsville Vermont Motor Vehicle Department Registration Temp License Ebay

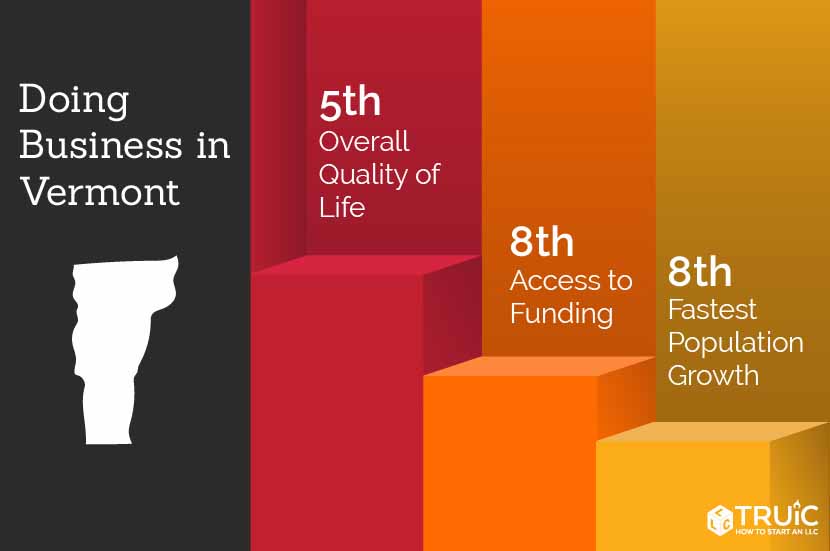

Ready to Relocate to Vermont.

Vermont small business registration. Welcome to the Vermont Economic Recovery Grants portal. From profit corporations to LLCs and Limited Partnerships you. What does it mean to be in good standing with the Office of the Secretary of State.

802 728-9101 or in VT 800 464-SBDC Fax. This portal has been created to disburse the Federal Coronavirus Aid Relief and Economic Security CARES Act funds to eligible entities and Vermonters affected by COVID-19. Vermont Women Business Center The Center for Women Enterprise.

Box 188 Randolph Center VT 05061. Small Business Development Centers and Womens Business Centers that provide additional business counseling and training. Business Start-Up Guide Step-by-step guide and resources for starting a new business in Vermont.

Our business center and industry guidance provide information and tools to help you get started. This program will provide immediate relief to small businesses with non-disaster SBA loans in particular 7a 504 and microloans. Register a Business in Vermont Step 1.

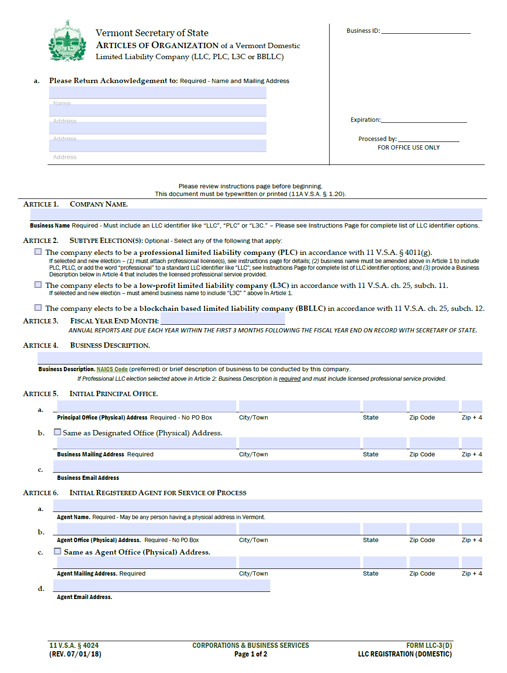

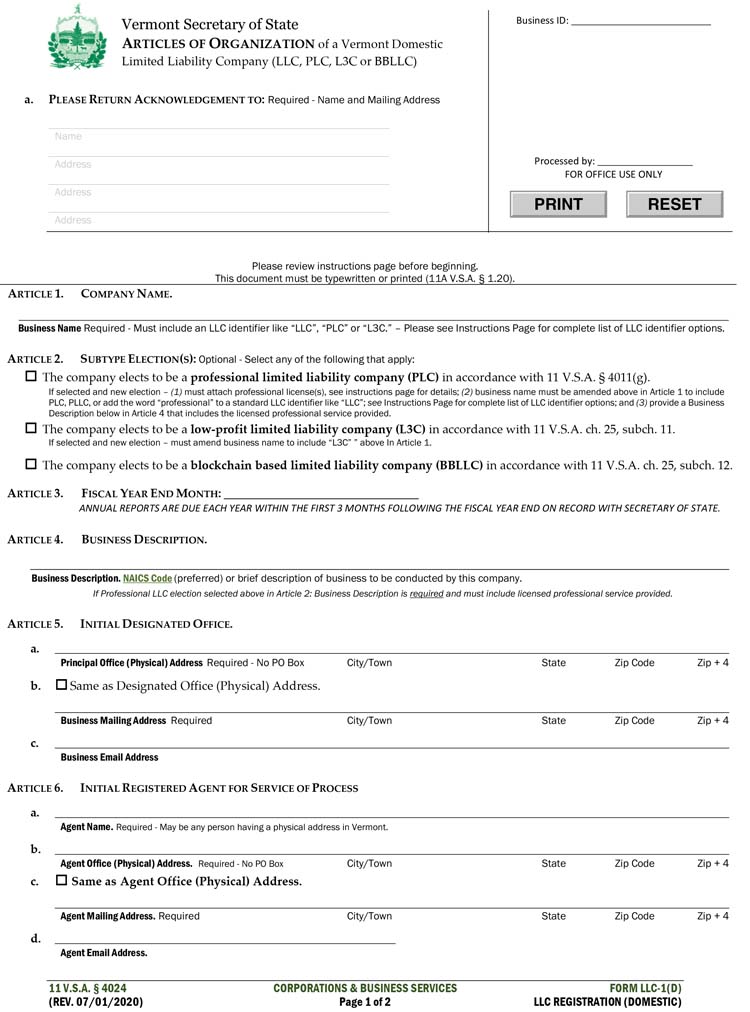

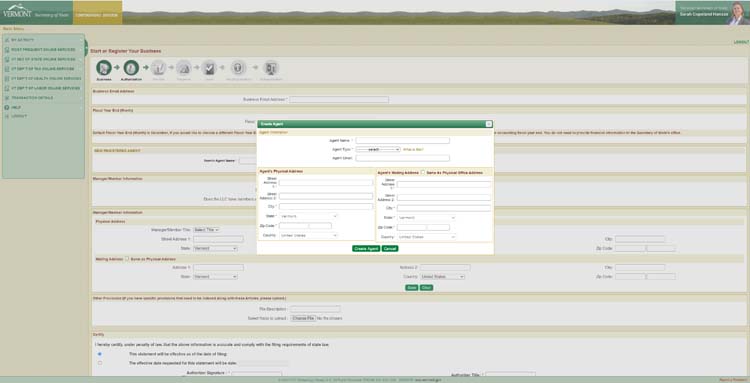

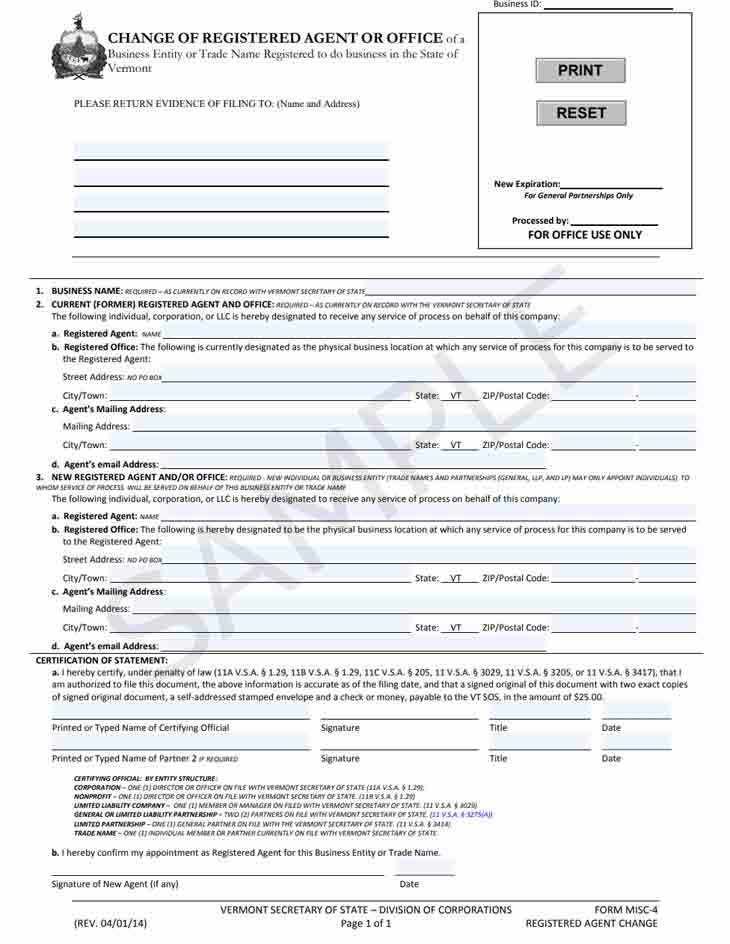

Those forming one of these two entities must first assign a registered agent to handle the service of process on the businesss behalf. Depending on your business type it may be necessary to register with the US Internal Revenue Service. If you are a sole proprietorship doing business in Vermont as your own personal name there is neither means nor need to register with the Secretary of State.

Taxes can be complex and we are here to help you navigate Vermonts taxes whether you are just starting your business or have been operating for years. Vehicle Registration Renew or apply for a new Vermont vehicle registration online. Eligible exempt organizations must also register prior to using an exemption certificate.

Corporations Business Services. The registered agent must be a business or individual authorized to operate in Vermont and have a physical address in the state. Funded in part through a Cooperative Agreement with the US.

Register for a Business Tax Account. Business Tax Center Find guidance on paying taxes as a business in Vermont. Funded in part through a Cooperative Agreement with the US.

There are three main resource websites to register your business in Vermont and the information on these websites is easily accessed and designed to be helpful for all types of businesses. Apply for licenses and permits. This is accomplished by filing a regular information statement called an Annual or Biennial Report.

Box 188 Randolph Center VT 05061. The Vermont Small Business Development Center VtSBDC has guidance on how to start and grow your business. Additionally you may wish to consult with an attorney and.

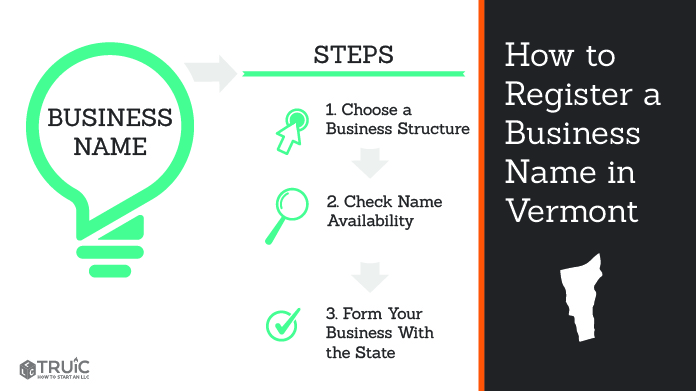

Depending on your business. Afterward you must register that name for your business whether youre going to reserve it file for a business with it or file for a trade name using our step-by-step instructions. Your required annualbiennial report or renewal filings are up to date.

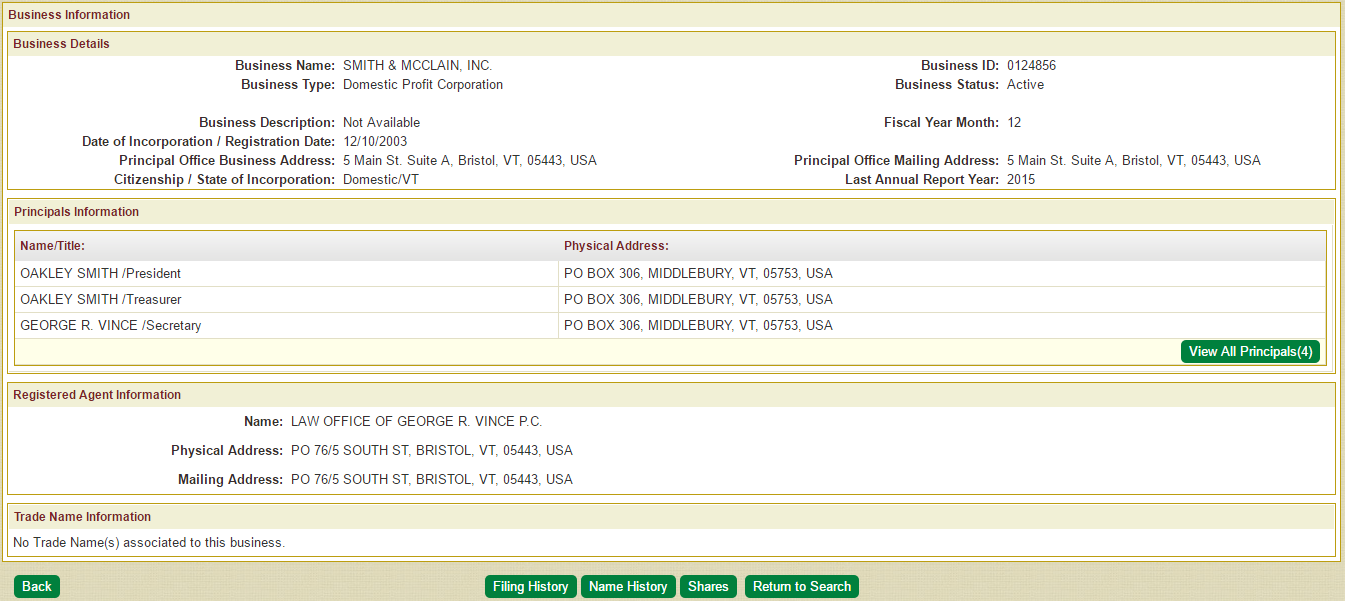

7 rows Business Name. If you are a sole proprietor doing business as a name other than your own personal name regardless of domestication you must register that name as an assumed business name. Get federal and state tax ID numbers.

The website includes an extensive list of Vermont small business development resources with links to websites. A business entity registered with the state of Vermont must maintain good standing for as long as it does business in Vermont. For Sales and Use Meals and Rooms or Withholding you will need a separate business tax account for each of these respective taxes.

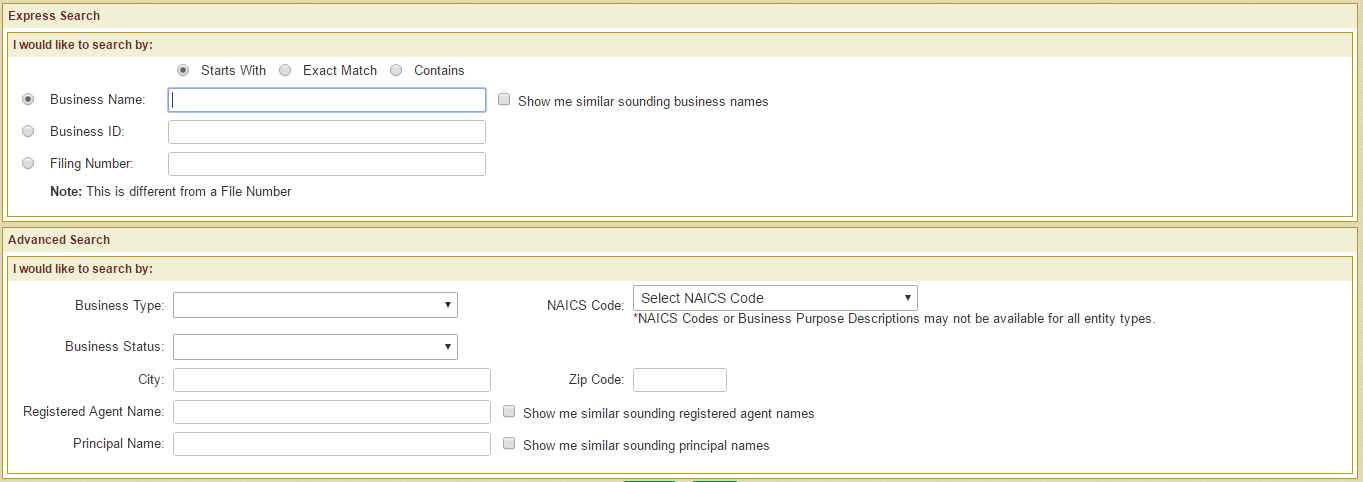

802 728-9101 or in VT 800 464-SBDC Fax. Vermont Small Business Development Center. To register a business name in Vermont you must first check to make sure your name is available by doing a business search a domain name search and a federal trademark search.

Under it Small Business Administration SBA will cover all loan payments on these SBA loans including principal interest and fees for six months. Business Registration Updates As a business entity registered with the state of Vermont the business entity must maintain its good standing for as long as it does business in Vermont. For LLCs and corporations.

There are also many other listed items. To improve the user experience we only require one registration to apply for the grants listed below. Most businesses operating in Vermont must first register with the Vermont Department of Taxes.

Show me similar sounding business names. 1540 Vermont Route 66 Randolph Vermont 05060 Tel.

How To Search Available Business Names In Vermont Startingyourbusiness Com

How To Search Available Business Names In Vermont Startingyourbusiness Com

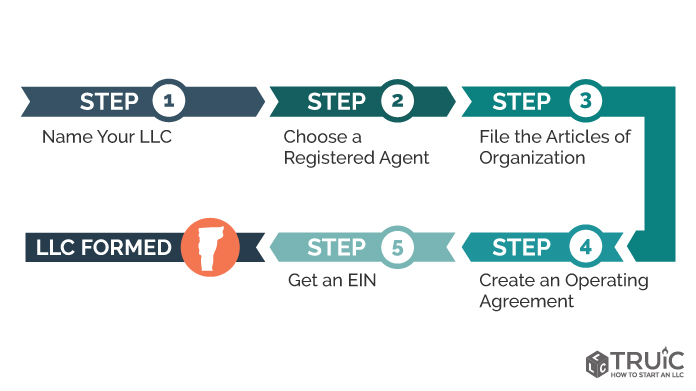

Vermont Llc How To Form An Llc In Vermont Truic Guides

Vermont Llc How To Form An Llc In Vermont Truic Guides

Vermont Llc How To Form An Llc In Vermont Truic Guides

Vermont Llc How To Form An Llc In Vermont Truic Guides

Vermont Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Vermont Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Vermont Llc Steps To Form An Llc In Vermont

How To Register A Business Name In Vermont How To Start An Llc

How To Register A Business Name In Vermont How To Start An Llc

Starting A Business In Vermont How To Start A Business In Vermont

Starting A Business In Vermont How To Start A Business In Vermont

Get A Title With A Vermont Registration Chin On The Tank Motorcycle Stuff In Philadelphia

Vermont Business License How To Get A Business License Truic

Vermont Business License How To Get A Business License Truic

Vermont Llcl Registered Agent Truic Guide

Vermont Llcl Registered Agent Truic Guide

Information Sheets Department Of Environmental Conservation

Information Sheets Department Of Environmental Conservation

Vermont Business Entity Search Corporation Llc Partnership Start Your Small Business Today

Vermont Business Entity Search Corporation Llc Partnership Start Your Small Business Today

How To Start A Business In Vermont A Truic Small Business Guide

How To Start A Business In Vermont A Truic Small Business Guide

Dba Vermont How To File A Vermont Dba

Dba Vermont How To File A Vermont Dba

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Vermont Llcl Registered Agent Truic Guide

Vermont Llcl Registered Agent Truic Guide

Vermont Llcl Registered Agent Truic Guide

Vermont Llcl Registered Agent Truic Guide

Incorporate In Vermont Do Business The Right Way