How To Get Professional Tax Registration Certificate In Karnataka

If tax is paid through e-payment then the there is no necessity for the person visit the PT office. Certificate by filing a return in Form 4A an acknowledgement will be generated for having paid the tax.

Procedure Of Professional Tax Registration Tax Registration Professional

Procedure Of Professional Tax Registration Tax Registration Professional

Following are the documents needed for registering for professional tax in Karnataka.

How to get professional tax registration certificate in karnataka. In Karnataka an online application has to be submitted in the prescribed format and all the documents required as per the type of entity the registration is sought for should be submitted in person at the department. Professional Tax is a tax collected by State Governments from the professionally occupied business entities. The application for enrolment or return and payments will be deemed to be acknowledged.

Karnataka Professional Tax Registration in Bangalore. When person is employed in profession by two or more employers and is getting salarywages exceeding Rs. Here is how an employer can get the registration certificate online.

Every employer except an officer of Government of Karnataka liable to pay tax shall obtain a Certificate of Registration under the Act. You will have to apply for PT Registration to obtain demat Certificate of Registration on-line through wwwwbcomtaxnicin Profession Tax. Every business entity in Karnataka shall obtain the Certificate of Enrollment EC from the Profession Tax Officer within Thirty days from the date of commencement business.

Go to the e-Prerana website. The person needs to get itself mandatorily registered within 30 days of starting the business or profession. Enter ZAccount number.

How can I obtain a Certificate of Registration RC. Is required to pay professional tax. Professional tax is a tax that is levied by some of the state governments in India.

Profession Tax PT is a tax levied on the employment and Profession by respective State Government in India. You may view and take the application submitted. The due dates for various persons have been provided in the Act.

Click here to download Enrolment Certificate. 5000 but employer is not deducting professional tax then the individual needs to get enrolment certificate from authority. CTD reference Number from Karnataka Professional Tax Challan retrieved after payment.

The new enrolment application can be submitted online and payment can be made accordingly and download the certificate online. PT Registration is to be done when the business employs any employee with a salary above Rs 15000 per month. Professional Tax Registration Process in Karnataka The Karnataka Commercial Taxes Department administers an online platform to file returns and pay taxes through the e-PRERANAA taxpayer can utilize the online portal for various e-facilities for instance filing of returns e-payment of taxes filing enrollment application etc.

PT Enrollment is to be done before the end of the financial year in which the business entity was formed. ZService tax registration no field is optional. In Karnataka it is referred to as the Karnataka Tax on Profession Trade Callings and Employment Act 1976.

Once a person is registered TIN is allotted by the department and the person can pay PT. All the employers should get certificate of registration from profession tax officer of applicable jurisdiction. Select ZBank Name from the list.

Copy of PAN permanent account number Card for applicants in case it is a company it is the directors PAN cards that would be needed. The same should be obtained within 30 days of becoming liable to pay professional tax. In Karnataka professional tax comprises of two parts - enrollment and registration.

You shall be granted the registration certificate. The already enrolled professionals can directly submit the return and make payment without any logging in process and download the certificate online. In most states Professional tax registration is an online process.

That entity is required to obtain registration certificate. Get the acknowledgement number Submit the physical copy of online application form in the particular regional circle After verification by the Senior Labour Inspector if everything is well. In both cases VATWBST you must have to enter ZRegistration number.

A person earning income from salary or professions such as Chartered Accountants Company Secretaries Lawyers etc. In Karnataka Profession Tax is levied under the Karnataka Tax on Professions Trades Callings and Employments Act 1976. Under the provision of the Act Profession Tax shall be paid by every person exercising any Profession or calling or is engaged in any trade or holds any.

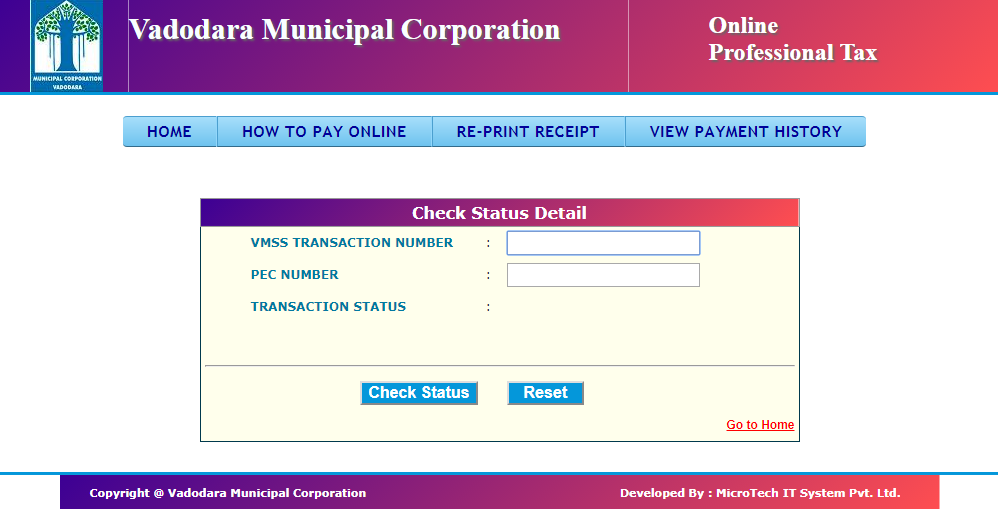

Click on Verify e-Payment tab. Enter ZBranch Name of the bank selected on previous option. This registration is mandatory for business whether they employ any people in employment or not.

ZRegistration Type VATWBST. Professional Tax Filing - Karnataka Govt. Kindly fill the following details.

Visit e-Payment system of Karnataka Commercial Tax department VAT. Exemption from Professional Tax Registration in Karnataka. Enter ZBranch IFSC code.

Every employer who is liable to pay the Profession Tax of his employees is mandated to obtain a certificate of registration first. Documents required for professional tax registration in Karnataka. In the left-hand bar click.

It is a mandatory registration for all businesses.

Contact Us For The Professional Tax Registration Starting A Business Professional Online Business

Contact Us For The Professional Tax Registration Starting A Business Professional Online Business

Http Pt Kar Nic In S Hqpdvp55i3ba5245od1cyy3s Downlods Usermanual En Pdf

Tds Is An Abbreviated Form Of Tax Deducted At Source Which Is Required To Be Deducted While Making Payment To Parties Tax Deductions Tax Deducted At Source Tax

Tds Is An Abbreviated Form Of Tax Deducted At Source Which Is Required To Be Deducted While Making Payment To Parties Tax Deductions Tax Deducted At Source Tax

How To Start A Cleaning Business 10 Steps Contact Weblium Team And Get The Ready Made Website For Yo Website Making Website Builder Free Building A Website

How To Start A Cleaning Business 10 Steps Contact Weblium Team And Get The Ready Made Website For Yo Website Making Website Builder Free Building A Website

Http Pt Kar Nic In S Hqpdvp55i3ba5245od1cyy3s Downlods Usermanual En Pdf

Http Pt Kar Nic In S Hqpdvp55i3ba5245od1cyy3s Downlods Usermanual En Pdf

Professional Tax Registration Karnataka Infographic Chartered Accountant Tax State Government

Professional Tax Registration Karnataka Infographic Chartered Accountant Tax State Government

Trademark Is Any Unique Name For Products Or Services That Can Be Differentiated From Others It May Be A Logo Gr Trademark Registration Registration Trademark

Trademark Is Any Unique Name For Products Or Services That Can Be Differentiated From Others It May Be A Logo Gr Trademark Registration Registration Trademark

Pin On Government Registrations

Pin On Government Registrations

Professional Tax Income Tax Return Professional Night Shift

Professional Tax Income Tax Return Professional Night Shift

Pan Card For Business Nsdl Pan Card Download Correction Lost Damage Nri Form How To Apply Political Map Opening A Business

Pan Card For Business Nsdl Pan Card Download Correction Lost Damage Nri Form How To Apply Political Map Opening A Business

Gujarat Professional Tax Applicability Due Date Indiafilings

Gujarat Professional Tax Applicability Due Date Indiafilings

How To Get Msme Registration Certificate In Bangalore India Bangalore India Registration Bangalore

How To Get Msme Registration Certificate In Bangalore India Bangalore India Registration Bangalore

Start Your Any Type Of Business At Any Place Of India Easily Visit At Http Www Public Limited Company Private Limited Company Limited Liability Partnership

Start Your Any Type Of Business At Any Place Of India Easily Visit At Http Www Public Limited Company Private Limited Company Limited Liability Partnership

How To Do Professional Tax Online Registration Karnataka Youtube

How To Do Professional Tax Online Registration Karnataka Youtube

How To Get Bis Registration Certificate In Bangalore India Registration One Time Password Hallmark

How To Get Bis Registration Certificate In Bangalore India Registration One Time Password Hallmark

Http Pt Kar Nic In S Hqpdvp55i3ba5245od1cyy3s Downlods Usermanual En Pdf

Gst Migration Registration For Existing Assessee Registration Consent Letter Internal Audit

Gst Migration Registration For Existing Assessee Registration Consent Letter Internal Audit

How To Get Back Professional Tax Quora