How To Check If A Business Is Registered For Gst In Australia

Immediately after submitting your application your Business Name will be reserved. If you anticipate that your GST turnover will be over 75000 you can register for GST and apply for your ABN at the same time.

If You Are Planning To Apply For The Particular State Of Australia Under Skilled Nominated Visa 190 Ca Goods And Services Accounting Jobs Goods And Service Tax

If You Are Planning To Apply For The Particular State Of Australia Under Skilled Nominated Visa 190 Ca Goods And Services Accounting Jobs Goods And Service Tax

Once you have an ABN you can register for GST.

How to check if a business is registered for gst in australia. You need an Australian Business Number ABN to register for GST as the ABN is part of the GST system. ABN Lookup is the free public view of the Australian Business Register ABR. Branches of entities will have an additional three digit GST or PAYG registration number that is a separate identification number for tax purposes sequential numbers repeating numbers or unusual number patterns.

If not this can be done through the Australian Taxation Office ATO via an online form a mail-in form or an in-person visit to their offices. Go to Business Registration details in the menu. Its a secure and more convenient login alternative to an AUSkey that can be used from any smart device.

Easier for business owners to check the ABN status of a supplier by linking directly to the ABN Lookup website. Through your registered tax agent or BAS agent. You can also register for GST via the Business Portal on the ATO website or HR Block can help you register.

By phone on 13 28 66. You can also register for GST through the ATO business portal. To check your business name details through the Business Names Index.

To save time you are able to apply for other business registrations as a part of your Australian business number ABN application. You can order a form. You pay this to the Australian Taxation Office ATO when its due.

Applying for GST PAYG and business names. Your ABN will also be your GST registration number. GST-registered businesses are required to submit business activity statements BAS on a regular basis.

Via Online services for business. To know which taxable period you want either monthly two-monthly or six-monthly for small businesses. The business portal is the main way for businesses to communicate with the ATO.

But dont worry the Australian Taxation Office ATO will automatically send you a BAS when its time for you to file. An email notification is sent when the order has been received and another email once the registration has been completed including a. Select the registrations radio button then select next.

If your business is registered for GST you have to collect this extra money one-eleventh of the sale price from your customers. Register for goods and services tax GST Goods and services tax GST is a tax of 10 on most goods services and other items sold or consumed in Australia. Getting ready to register for GST external link Inland Revenue.

You can also submit your BAS via online accounting software. To register for GST you will need to complete an application. If youre ready to take the plunge and become a GST business rest assured GST registration isnt too complex.

Its also where you will submit your business activity statements BAS. GST-Check Supplier ABN and GST Status April 2015. The ABR is the central registry of Australian business information so as well as getting an ABN and registering for GST you can get a business tax file number TFN apply for pay-as-you-go PAYG withholding and register your business name.

Step 1 - Go to ASIC Connect search Step 2 - Select Business Names Index from the drop down box in the top right corner Step 3 - Enter the ABN or name of the business youre looking for. You may check online if a business is GST-registered via the Register of GST-registered Businesses. If your application is refused you wont be able to apply for other business registrations.

How to register for GST. Search can be done using the name or tax reference number of the business. Once your registration is approved you will receive your official record of registration for business.

Youll see a list of matching results on the business names register. You will receive an email from us confirming that we have processed your business name registration. By completing the Add a new business account NAT 2954 form.

Ensure your business has an Australian Business Number ABN. Invoice details that dont match the details of the person you believed was supplying you or the type of supplies you are receiving. Register online through myIR.

Your business industry classification BIC code. If you need to apply for business registrations separately you need to register directly with the relevant government agency. Select Activity Stmnt and select Add tax type.

Use form NAT 2954 order it here call the ATO. Other ways to register You can. It provides access to publicly available information supplied by businesses when they register for an Australian Business.

In the following 24 business hours you will receive a GST registration confirmation email including a confirmation attachment from the ATO portal.

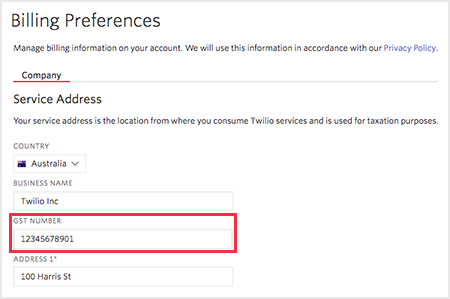

Does Twilio Inc Us Entity Charge Goods And Services Tax Gst In Australia Twilio Support

Does Twilio Inc Us Entity Charge Goods And Services Tax Gst In Australia Twilio Support

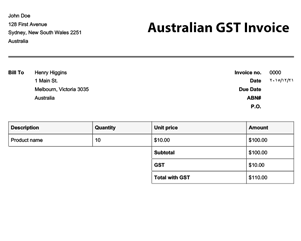

Australian Gst Invoice Template With Sample Tax Invoice Template Australia 10 Professional Templates Ideas Invoice Template Business Template Create Invoice

Australian Gst Invoice Template With Sample Tax Invoice Template Australia 10 Professional Templates Ideas Invoice Template Business Template Create Invoice

Free Australian Gst Invoice Template Online Invoices

Free Australian Gst Invoice Template Online Invoices

Australian Gst Invoice Template With Sample Tax Invoice Template Australia 10 Professional Templates Ideas Invoice Template Business Template Create Invoice

Australian Gst Invoice Template With Sample Tax Invoice Template Australia 10 Professional Templates Ideas Invoice Template Business Template Create Invoice

Free Printable Business Plan Template Fresh Free 32 Sample Business Plans Business Plan Template Word Business Plan Template Pdf Simple Business Plan Template

Free Printable Business Plan Template Fresh Free 32 Sample Business Plans Business Plan Template Word Business Plan Template Pdf Simple Business Plan Template

Paying Gst On Your Timely Invoices Australia Timely

Paying Gst On Your Timely Invoices Australia Timely

How To Sell On Paytm The Ultimate Guide Things To Sell Business Bank Account Public Limited Company

How To Sell On Paytm The Ultimate Guide Things To Sell Business Bank Account Public Limited Company

Australia Employer Of Record Overview Shield Geo

Australian Gst Rules Rates Configuration Options Chargebee Docs

Australian Gst Rules Rates Configuration Options Chargebee Docs

Cis Invoice Template Subcontractor Vat Sample Tax Example Excel In Cis Invoice Template Subcontractor 10 Pr Invoice Template Invoice Template Word Templates

Cis Invoice Template Subcontractor Vat Sample Tax Example Excel In Cis Invoice Template Subcontractor 10 Pr Invoice Template Invoice Template Word Templates

What Are The Basic Tax Returns In Australia Income Tax Return Tax Refund Tax Return

What Are The Basic Tax Returns In Australia Income Tax Return Tax Refund Tax Return

Australian Gst Rules Rates Configuration Options Chargebee Docs

Australian Gst Rules Rates Configuration Options Chargebee Docs

Consent Letter Format For Gst Registration In Word In 2021 Consent Letter Consent Letter Format Consent Letter Sample

Consent Letter Format For Gst Registration In Word In 2021 Consent Letter Consent Letter Format Consent Letter Sample

Australian Gst Rules Rates Configuration Options Chargebee Docs

Australian Gst Rules Rates Configuration Options Chargebee Docs

Pin By Gst Suvidha Kendra On Https Twitter Com Kendra Gst Money Transfer Filing Taxes How To Apply

Pin By Gst Suvidha Kendra On Https Twitter Com Kendra Gst Money Transfer Filing Taxes How To Apply

Australian Gst Rules Rates Configuration Options Chargebee Docs

Australian Gst Rules Rates Configuration Options Chargebee Docs

Australian Gst Invoice Template Intended For Sample Tax Invoice Template Australia 10 Professiona Invoice Template Invoice Template Word Price List Template

Australian Gst Invoice Template Intended For Sample Tax Invoice Template Australia 10 Professiona Invoice Template Invoice Template Word Price List Template

دروس تقوية محاسبة الدرس 4 Calculator Accounting Finance

دروس تقوية محاسبة الدرس 4 Calculator Accounting Finance

Paying Gst On Your Timely Invoices Australia Timely

Paying Gst On Your Timely Invoices Australia Timely